Favoritism in providing OTT services denies the treasury of Millions in profits

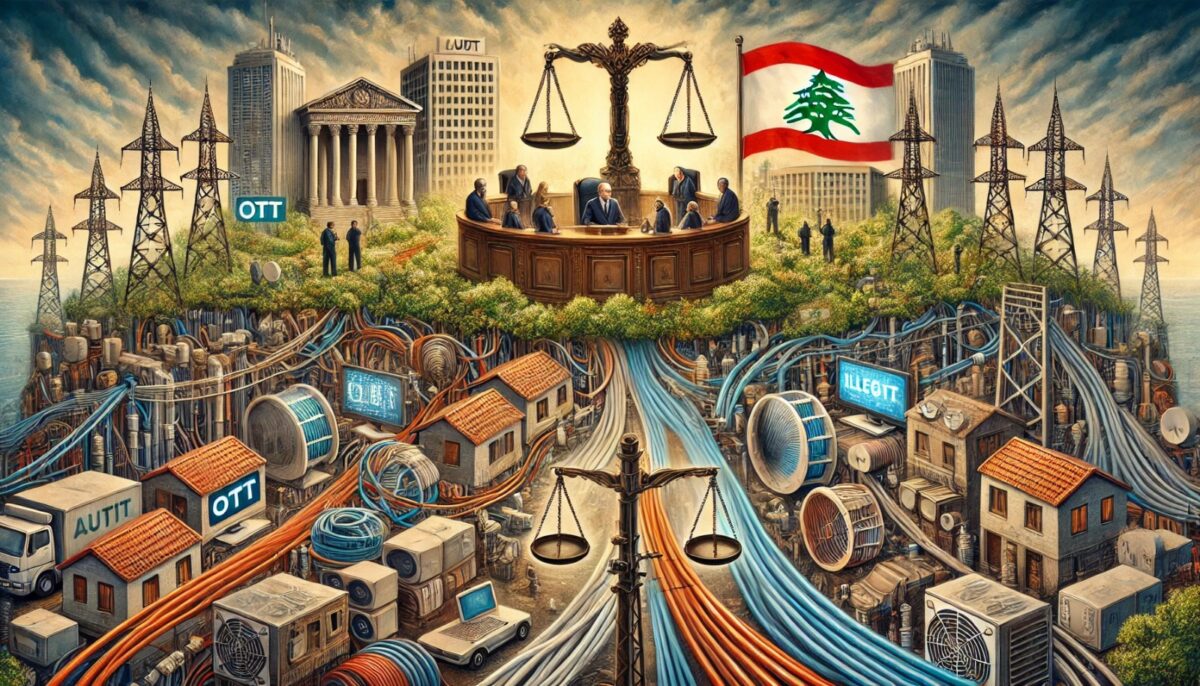

Lebanon’s Audit Court has given a stranded veto over the use of over-the-top (OTT) services as added-value services streamed via the internet. The Court of Auditors’ rejection of the Ministry of Telecommunications’ contract with Stream Media company to operate the OTT system was nothing short of a bombshell. The Court’s decision pulled back the curtain on blatant criminal acts under the Penal Code, particularly the attempt to secure illegal profits and the questionable choice to contract with a company that’s more of a shell than a business—lacking any real technical, professional, or financial qualifications.

Obviously the service was lobbied against by illegal internet and cable neighborhood roasters. OGERO the public and exclusive internet provider’s share of the internet market has shrunk in favor of illegal operators. The illegal sector serves nearly 700,000 subscribers, which is double the number of OGERO subscribers and the declared subscribers of private companies.

At least 60% of internet service providers in Lebanon operate illegally without a license. Web access is widespread in Lebanon, with 76% of the population having access to it, while one-third of the world’s population lacks this privilege (according to 2022 figures). It’s estimated that around 700,000 people are subscribed to illegal networks. Internet services in Lebanon are provided by OGERO, through licensed companies (107 in total, such as IDM, Inconet, etc.), or through mobile operators Touch and Alfa, which sell 3G and 4G services, or through unlicensed companies, commonly called neighborhood distributors. The latter account for 60% of the market. It should be noted that while the legal access providers go through OGERO, the illicit ones are not controlled by the official provider and have their own networks.

Millions lost!!

According to OGERO, this service was expected to generate millions of dollars for the Treasury, reduce pirated content, help protect IP rights, and legalize the way Lebanese people consume media. However political favoritism chose to veto the liberalization fo these services. According to a detailed report from the Audit Bureau on the telecommunications sector as of November 11, 2021, OGERO has 280,000 subscribers and uses 92 gigabits per second (Gbps) of international capacity to cover their internet usage. Licensed companies, serving 145,000 registered subscribers, consume 470 Gbps to provide services (although they only need 43 Gbps to cover their registered users), the report stated. This indicates that these companies are purchasing far more capacity than necessary, suggesting they are catering to illegal market demands for internet capacity. Remarkably, 90% of these companies have unauthorized networks. The report also notes that 36 out of 96 companies hold 80% of the leased capacities from the government. Ogero itself disclosed an increase of 157,889 unregistered subscribers from companies within the first two months of 2022, compared to a decrease of 126 registered subscribers. Notably, Ogero’s letter included names of several licensed companies whose sole function appears to be selling internet to unlicensed networks, without having any legitimate subscribers themselves. This raises questions about how these companies were licensed in the first place and how they continue to operate in the market.

According to a study, illegal competitors currently hold the largest market share at 81%, with revenue reaching Usd25.9 million (calculations were made based on 400,000 out of 700,000 having similar services) with an average subscription rate of $4.5 per month. The legitimate competitors are: “Cable Vision” (owned by GDS), which is estimated to have revenue of $5.1 million in 2024 based on an average subscription rate of Usd9.5 per month, and Samaflix/Digitech (owned by Mohammad Mansour), which could reach revenue of Usd700,000 in 2024 based on an average subscription rate of a monthly Usd6.

The study indicates that illegal competitors offer pirated international, local, and sports content at a monthly subscription rate ranging from $3 to $5 per subscriber, with very poor content quality. As for “Samaflix,” which provides pirated content, including pirated sports content (the Ministry of Telecommunications has received several letters from companies like beIN and French channels, among others, requesting that Samaflix be prevented from broadcasting pirated content), its subscription rate ranges from $5 to $7 with average quality. However, “Cable Vision” offers better content quality with a monthly subscription rate ranging from Usd7 to Usd12.

The special packages that will be offered through Ostream include the Basic Package, with a monthly subscription of Usd4, allowing access to local channels and international content. The study expects that 67% of total subscribers will choose this service. The Premium Package, with a monthly subscription of $8, includes the Basic Package plus sports content and a Video on Demand (VOD) service, and the study estimates that 33% of subscribers will opt for this service. It should be noted that the subscription is intended for one television device, with each additional subscription within the same household costing Usd2.

These subscriptions and the expected profits from them are calculated based on the premise that every gigabyte of consumption provided by OGERO to the subscriber is not deducted from the household’s internet consumption. In other words, the subscriptions collected from subscribers include both the cost of the internet and the cost of the package. Therefore, the revenue-sharing calculations, the cost of packages, internet, and profits, are split between OGERO and the service providers. The study indicates that providing services to the expected number of subscribers will consume 400 GB per household per month, with total consumption expected to increase from 57 million GB in the first year, costing $165,000, to 527 million GB, costing $1.5 million after ten years.

In summary the Court of Audit in Lebanon could really use an audit of its own—because, let’s be honest, their decisions are starting to look like they were made at a political party’s annual picnic. With each passing day, it’s becoming painfully clear that the so-called impartial judges are less concerned with upholding the law and more focused on making sure they keep the right politicians happy. It’s almost like they’re auditioning for a role in a soap opera, where drama and bias take center stage, and justice is just a forgotten subplot. Perhaps it’s time for the auditors to get audited—just to see who they’re really working for

The OTT market is witnessing a steady increase in quantity and quality, and its market value is expected to reach about $250 billion globally by 2027. From this perspective in particular, limiting this service locally to a single company not only misses the opportunity for fair competition and the consumer’s freedom of choice based on price and services, but also misses out on the economy from the emergence of many platforms. Attracting foreign investments in this field, with all that it provides in terms of creating job opportunities, developing the economy, and increasing the state’s financial returns from fees and taxes.

OTT may include messages, audio and video content, or TV programs and films upon demand. Many examples of OTT service providers and applications used by subscribers in Lebanon include Netflix, Amazon Prime, Apple TV, Shahid, and several other platforms streaming content online. Previously, this service required an IPTV set-top box to be available in landline subscribers’ homes; now, however, it can be enabled through smart TV or smartphone applications.

OTT, the tech that’s supposed to save us from the stone age of content delivery, is so advanced it doesn’t even need cables or satellites. You can stream anything—videos, music, social media, whatever—right to your smart TV, computer, or even your phone. But here’s the kicker: OGERO chose OTT over IPTV to dodge the legal landmines. Decree No. 9458 graciously allows public and private entities to sell pretty much nothing except what’s dictated by the Ministry of Telecommunications. But, OTT is in the clear according to some opinion from the Legislation and Consultation Commission—unless, of course, corruption does what it does best in Lebanon and manages to put the brakes on this too. So, will this OTT service ever see the light of day? Let’s just say the chances are about as high as a clean, transparent government contract in Lebanon

However, the Legislation and Consultation Committee authorized OGERO to take charge of the OTT project under certain conditions. For example, “OGERO may establish partnerships with the private sector as part of the duties entrusted to it following the contract signed with the Ministry of Telecommunications.” In addition, “these partnerships must meet the conditions mentioned in the regulations on public-private partnerships.” The Legislation and Consultation Committee also stressed the need to announce tenders and disclose the names of private sector partners, which has yet to be done.

The OTT service is a content streaming technology that differs from traditional methods like cable or satellite for delivering and broadcasting content. Through this mechanism, videos, music, entertainment, and everything related to social media can be streamed and accessed via smart TVs, computers, tablets, and smartphones. This technology was chosen instead of IPTV to ensure the project’s legal compliance. According to Paragraph 4 of Article 6 in Decree No. 9458, public and private institutions are prohibited from selling voice marketing services (VoIP) or IPTV services, among others, as these services are exclusively reserved for the Ministry of Telecommunications. However, Paragraph 4 of Article 4 of the same decree allows the use of OTT services as outlined in the opinion of the Legislation and Consultation Commission.

How OTT became Lebanon lost gold mine

Last November, Lebanon’s Council of Ministers discussed the possibility to grant Ogero, the country’s exclusive provider of fixed and mobile internet services, the authorization to stream OTT content freely on the internet, particularly television content broadcasting in partnership with the parties that have licensed it.

While the Minister of Telecommunications claims that a private company will not be contracted to offer the OTT services, media reports have indicated that “the Ministry of Telecommunications will not offer the service directly, and that only one bidder is proposing to offer the OTT service – a company called ‘Stream Media’ which has been in the news lately. According to the proposal submitted by this private company, OGERO’s share of the revenue will not exceed 10%. At the same time, neither the Ministry of Telecommunications nor OGERO will have any substantial role in the process.” The proposal submitted by Stream Media and signed by Ogero dates back to March 2023, which implies that certain companies had been secretly gearing up to win the OTT project. This shows that OGERO’s low share of the revenue had long been part of the plan. The Audit Bureau’s decision No. 105/RM/G2, was a thunderbolt regarding the agreement to operate the OTT platform and broadcast content through it, which was prepared to be signed with Stream Media S.A.L.

The Audit court claimed that this company submitted a statement to the Ministry of Finance stating that it did not practice the profession for the years 2022 and 2023 and evaded taxes on profits on the pretext that it had no profits due to not practicing the work, meaning that its experience in its field of work was zero. Another reason for the decision was illustrated by the fact that the contract proposed by the Minister of Telecommunications to the Audit Bureau strikes at the heart of the Competition Law (Law No. 281 dated 3/15/2022). Also in violation of the rules of contract the Audit Bureau decision states that Stream Media is not registered with social security and does not pay any subscriptions.

Another alleged violation comes to the fact that the non-confidential contract was not published on the Public Procurement Authority’s website, in violation of the provisions of Article 62 of the Public Procurement Law. The public was not informed of a summary of the provisions of the proposed contract, and local bidders were not given the opportunity to submit their objections due to the absence of publication. This was similar to smuggling. The absence of this publication creates a fundamental defect in the contracting procedures because it disrupts the constitutionally and legally enshrined right to object and exposes the contract to invalidation.

OGERO argument

Imad Kreidieh, Ogero’s Chairman of the Board and Director-General, made quite a statement, declaring, “The IPTV service, which relies on landlines, is basically a dinosaur at this point. The sector has to catch up with the latest developments.” He went on to explain that “IPTV is a pricey option for subscribers, demanding cables and set-top boxes for every TV, whereas OTT services are cheaper and offer customizable bundles to suit users’ needs.”

Kreidieh also took a jab at the illegal cable distributors, who dominate the market with their shoddy services. He praised OTT as a solution that not only delivers high-quality content over the internet but also protects intellectual property rights, cuts down on the eyesore of cables crisscrossing our streets and buildings, and reduces the satellite dish jungle on rooftops. Yet, there’s a glaring question mark hovering over Ogero’s ability to solve these issues with its upcoming application, especially when its internet network barely covers a third of the market. Most people turn to illegal providers, and even Ogero’s loyal subscribers are plagued by constant service interruptions. So, will OTT really be the magic fix, or just another pipe dream?

Kreidieh emphasized that “this project is a game-changer for Ogero subscribers, bringing a service to the public sector that was previously out of reach for most, only available through a handful of private companies.” He boasted that Ogero users would be able to access this service at wallet-friendly rates, starting as low as $4 per bundle and capping at $13, depending on their choices. Kreidieh was quick to point out that Ogero’s upcoming platform, along with its actions under the Ministry of Telecommunications, aligns perfectly with Article 46 of the Public Procurement Law, which allows Ogero to acquire content from an individual holding exclusive rights through a consensual agreement—something the State is keen on.

While Lebanon’s TV channel owners have rolled out the red carpet for the OTT service, singing its praises in their news reports, Kreidieh is confident that this service “will legitimize how content creators earn their money, funneling income back into the Ministry of Telecommunications and Ogero. Our platform respects the IP rights of TV channels, unlike those pesky cable distributors who conveniently skip out on paying what’s due to the TV channel owners. “The platform benefits from Ogero’s 400,000 landline and internet subscribers, and it estimates that its revenue from the platform will be around 15% of the total sales of content bundles or packages, aiming to reach a market share of 200,000 subscribers in ten years, with revenues of Usd15 million. Regardless of the technical name of this service (OTT), Ogero will create a content service platform called “Ostream.” Ogero will contract with service providers to broadcast exclusive content packages to subscribers, such as Netflix, Max, beIN, Disney, Paramount, Showtime, OSN, etc. Each package results from exclusive contracts between the original content owner or production company and a local service provider, delivered through the platform. So far, only one company, “Media Stream,” has proposed broadcasting content using the mentioned technology after securing initial exclusive contracts from a group of television content providers, most notably a contract with beIN. This company is the result of three institutions with television broadcasting licenses in Lebanon (New TV, LBC, MTV) and is managed by Benjamin Hajar.

Providing this service requires the internet, making internet consumption fundamental to this process. Therefore, for OGERO, it becomes easier to compete with similar service providers, as long as it has a wide subscriber base and since it is the one providing them with internet service. This allows OGERO to offer packages that include both data consumption and content at competitive rates. According to Ogero’s study, the size of this market is estimated at about 1.1 million subscribers, including 400,000 internet subscribers with OGERO and 700,000 with illegal distributors.

This large customer base will allow OGERO to increase the total number of subscribers to the Ostream platform to 24,000 in the first year, reaching 109,000 subscribers in the tenth year, with OGERO having an indirect market penetration that allows it to benefit from 46,000 subscribers in the first year and 200,000 subscribers in the tenth year. The cost for OGERO in the first year is Usd165,000, increasing to $1.5 million in the tenth year, with these figures calculated based on a monthly consumption of 400 GB at a rate of $0.0029 per GB. (Subscribers through the OGERO platform will not pay for the internet they consume to watch the content but will only pay for the content bundles or packages).

OGERO will share the subscription revenue with local service providers at a rate of 15% of sales. It is estimated that OGERO’s expected revenue in the first year after launching the project will be $1.7 million, increasing annually to reach $15 million after ten years from a market estimated to be worth around Usd32 million in total. To be noted is that 31% of global monthly digital purchases are spent on movies and online television streaming services as Usd6 is the expected average monthly subscription rate for the packages OGERO plans to offer if the project proceeds. This subscription level is designed to be competitive in the market, offering relatively high-quality content streaming. The price for the basic package will be Usd4, and the price for the “premium” package will be $8 (with sports content being the primary feature), in addition to Usd2 for each additional device.

Free Concessions or Market Liberalization?

The recent decision by Lebanon’s Court of Audit to reject the Ministry of Communications’ agreement with Stream Media for operating the OTT system reeks of political bias and favoritism, highlighting the Court’s deep entanglement with Lebanon’s entrenched political and economic interests. Despite the clear advantages that OTT services would bring, including legalizing content distribution and boosting revenue for the public sector, the Court’s abrupt rejection reveals a disturbing pattern. Instead of serving as an impartial guardian of public finances, the Court appears to be safeguarding the interests of the political elite who benefit from the status quo.

This decision is a glaring example of how the Court is manipulated to protect the economic dominance of Lebanon’s political junta, who have long profited from illegal and unregulated services. By obstructing the implementation of OTT services, which threaten the monopoly of unlicensed cable distributors and other vested interests, the Court is perpetuating a system of favoritism that benefits a select few at the expense of the public good. The move underscores the urgent need for an independent audit of the Court itself, to expose and dismantle the networks of influence that continue to undermine fair competition and stymie progress in Lebanon.

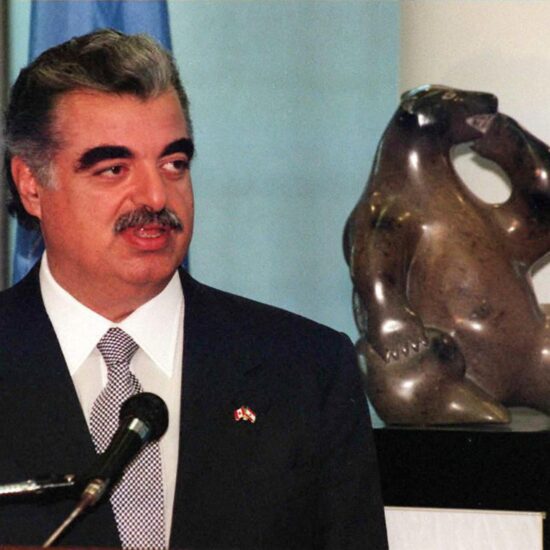

Maan Barazy is an economist and founder and president of the National Council of Entrepreneurship and Innovation. He tweets @maanbarazy.

The views in this story reflect those of the author alone and do not necessarily reflect the beliefs of NOW.