As the Israel-Gaza conflict escalates, Lebanon’s economy faces severe peril, echoing the 2006 Israeli war.

The spillover of the Israel-Gaza conflict into Lebanon threatens to push its economy into an abyss, severely damaging the nation’s fragile infrastructure, experts warn. Concerns have grown that the conflict could engulf the entire region, with Israel and Hezbollah exchanging gunfire and shells. Lebanon is ill-equipped for a large-scale military confrontation with Israel, surpassing the intensity of the 2006 Israel-Lebanon War, which inflicted direct war damage of $2.8 billion and lost output and income of $2.2 billion in 2006. The fragile exchange rates, although somewhat stable since mid-2023, remain vulnerable due to ongoing instability.

Lebanon’s financial crisis has worsened, with vested interests resisting crucial reforms, as warned by the International Monetary Fund (IMF). Public debt could soar to 547 percent of GDP by 2027 without reforms, making the current debt levels of over 280 percent of GDP already “unsustainable.”

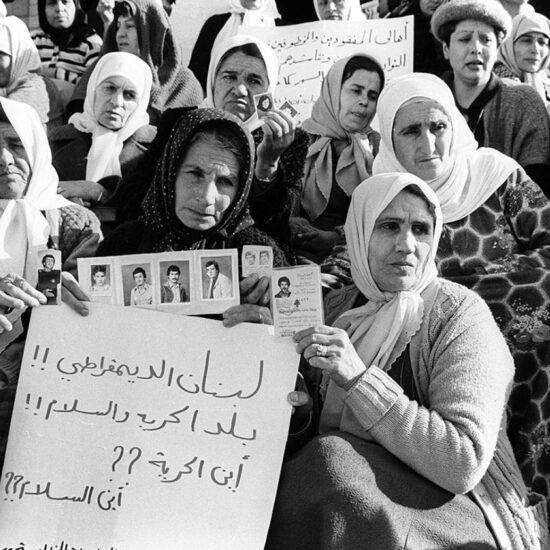

The 2006 war cost Lebanon dearly, resulting in substantial direct financial damage, significant indirect economic consequences, and heavy losses in sectors like agriculture. The conflict claimed numerous lives and led to massive displacement, destruction of homes, and contamination by unexploded ordnance.

Lebanon’s economic crisis over the past four years has seen drastic currency devaluation, a 40 percent contraction in GDP, triple-digit inflation, and depletion of foreign currency reserves.

The escalation of a war in Lebanese territory could cause further economic losses and destabilize financial and monetary conditions, according to Marwan Barakat, Chief Economist of Banque Audi. Lebanon’s already weak economic outlook, frail financial situation, and unresolved domestic political challenges make it ill-prepared for the current conflict. Additionally, its ties with the Gulf States may not offer substantial reconstruction funds, while the conflict’s expansion could disrupt offshore hydrocarbon exploration—a crucial aspect of Lebanon’s economic recovery.

The tourism sector, which had shown growth, is now in jeopardy, with canceled plans and postponed events due to the ongoing situation. Beirut’s hotel occupancy has declined, and business events have been postponed, while Rafic Hariri International Airport saw improvements in passenger numbers in July 2023.

Lebanon’s economy has already experienced a sharp decline, with high inflation, rising costs of energy and living, and increased import bills that put pressure on the exchange rate. The corporate sector is likely to postpone expansion and investment plans, and the trade deficit persists. Skilled professionals are emigrating, and investment in physical capital remains limited.

Reconstruction post-conflict poses a significant challenge, with Lebanon’s diminished foreign exchange reserves compared to previous years. Foreign aid has been absent since 2019, and Lebanon’s pegged exchange rate no longer provides a safety net. Donors pledged funds for reconstruction, contingent on economic reforms that the government has failed to implement.

Structural reforms and decisive policy actions are vital to restore confidence and enable economic recovery. The continuation of the political status quo presents the greatest risk to Lebanon’s economic outlook, regardless of war or peace.

Maan Barazy is an economist and founder and president of the National Council of Entrepreneurship and Innovation. He tweets @maanbarazy.

The views in this story reflect those of the author alone and do not necessarily reflect the beliefs of NOW.