Is the Lebanese government able to secure public employees’ salaries following a categorical NO FREE MONEY of the Deputy Governor of the Banque du Liban, Wassim Mansouri?

Monitoring the latest statistics on money in circulation and foreign reserves, it became clear that the problem of salaries is not just that they are tied to a quid pro quo between the Central Bank of Lebanon (BDL), the parliament, and the government.

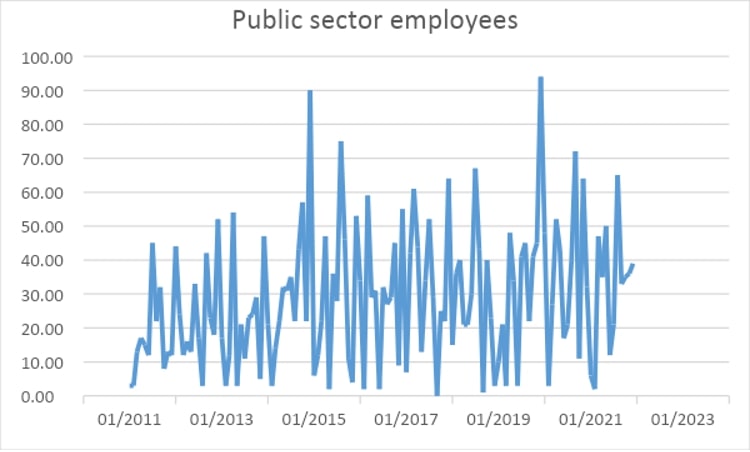

The average salary for the public sector in Lebanon is 638,864,159 LBP per year. The most typical earning is 488,160,011 LBP. On April 18, Lebanon’s caretaker cabinet approved a decision to raise public sector salaries and the nation’s minimum wage in an effort to match the local currency’s rapid devaluation amid a shortage of US dollar reserves and growing public discontent. The Central Bank is asking for a law for each expenditure and a cap on government borrowing following the stepping down of Central Bank governor Riad Salameh on July 31.

An additional supplement of 4.5 million LBP ($45) was added to private sector salaries — an apparent bid to counter rapid inflation and currency devaluation. The cabinet also increased transport allowances for civil servants and public teachers, who often lack the means to commute to work due to the exponential devaluation of their salaries. The public sector continues to demand a fixed exchange rate against the dollar, which will be used to calculate salaries and pensions.

A monthly minimum wage of less than 25 dollars, the devaluation of the national currency, and about 2.2 million people in or at risk of poverty exemplify the difficulties of the Lebanese, according to specialized entities of the United Nations.

Accordingly, public sector employees faced a salary crisis, as it is customary for them to receive their salaries in dollars through a banking platform. This is no longer an issue – at least this month. The crisis centers on the inability to pay employees’ salaries in US dollars. Seemingly the Banque du Liban is reluctant in securing a trading tool in hard currency to enable buying dollars at market price. The authoritative Fitch rating agency stated last week that it forecast Lebanon’s GDP growth to decelerate from 3.5 percent in 2022 to 1.5 percent in 2023 as the country continues to grapple with high inflation, a collapse in the provision of public services, and an unresolved banking crisis.

It is important to stress that tight monetary policies resulted in some of the slowing down of growth, while the rise of geo-economic fragmentation harmed most of the emerging and developing economies. Moreover, inadequate progress on the climate transition would leave poorer countries more exposed to increasingly severe climate shocks and rising temperatures. The outlook remains challenging and the touchdown may seem complex to execute, but risks to inflation are now more balanced and most economies are less likely to need additional outsized increases in interest rates. All the while, central banks should monitor the financial system closely and maintain financial stability in the coming period. Lebanon’s inflation will accelerate from 171.2 percent in 2022 to a nearly four-decade-high of 255 percent in 2023, according to Fitch Solutions. Additional hikes in custom tariffs, a weaker currency, and the absence of price control will keep inflationary pressures elevated throughout the remainder of 2023. it reported.

Starting in 2001, BDL measures imposed voluntary dollarization on the economy and made preserving the peg the ultimate goal of monetary policy. Consequently, using reserves erodes customers’ deposits. BDL’s USD reserve liabilities have been a prime catalyst of the currency crisis. According to its balance sheet, the Central Bank’s total assets fell by 39.15 percent compared to last year, to reach $103.09 billion by the end of July 2023. The fall was mainly due to the 90.52 percent year-on-year (YOY) drop in other assets, grasping 6.48 percent of BDL’s total assets and reaching $6.67 billion by the end of July 2023. Furthermore, the Gold Account, representing 17.50 percent of BDL’s total assets, increased by 10.89 percent yearly to reach $18.03 billion by the end of July 2023. Fitch Solutions believe that political risk in Lebanon is rising, prompting us to revise the country’s score on our Short-Term Political Risk Index (STPRI) down from 38.5 to 37.5 out of 100. The worsening political division will prolong the presidential and executive vacuum and reduce the probability of a final agreement with the IMF.

Seemingly, the problem lies in the evasion of responsibility, and the avoidance of harsh or difficult decisions that would produce solutions in the long term as to who should take the responsibility of the borrowing. Therefore, the idea of passing special legislation to borrow in foreign currencies is wishful thinking – or so it seems. These factors signal that political risk in Lebanon is rising,

BDL’s foreign assets, consisting of 13.37 percent of total assets dropped by 9.11 percent YOY, and stood at $13.78 billion by the end of July 2023, noting that BDL holds in its foreign assets $5 billion in Lebanese Eurobonds. In parallel, interestingly, other liabilities plunged by 72.61 percent YOY, and 54.82 percent on a monthly basis to stand at $1.10 billion by the end of July 2023. Also interesting to mention is that the capital account of BDL has remarkably increased by 25.73 percent on a monthly basis to stand at $899.11 million by the end of July, noting that it almost remained constant during the last two years, with the exception of February 2023 at the time of official rate’s modification.

In the medium and long run, even if the financing outlook improves, experts believe Lebanon’s current trajectory will be unsustainable due to the current imbalances on the fiscal side and the high cost of fueling public expenditures. This is because Lebanon’s external financing is non-debt-creating (in the form of remittances and deposit inflows) while financing the government deficit clearly implies a rapid build-up in public debt.

Maan Barazy is an economist and founder and president of the National Council of Entrepreneurship and Innovation. He tweets @maanbarazy.

The views in this story reflect those of the author alone and do not necessarily reflect the beliefs of NOW.