The Lebanese Central Bank on Thursday revoked a decision it made a day before to scrap the 3,900 Lebanese Pound per dollar rate and force banks to settle dollar deposits at the official rate of 1,500 LBP to the dollar.

Lebanese banks have been functioning under informal capital control since October 2019. The banks do not allow dollar withdrawals and limit lira cash withdrawals. The Lebanese Central Bank has used the fixed exchange rate of 1,500 LBP/dollar for three decades, but as the economic crisis saw the local currency plunging the commercial banks only release cash for 3,900 LBP/dollar, while the market rate fluctuates and saw the dollar sold at 13,000 LBP.

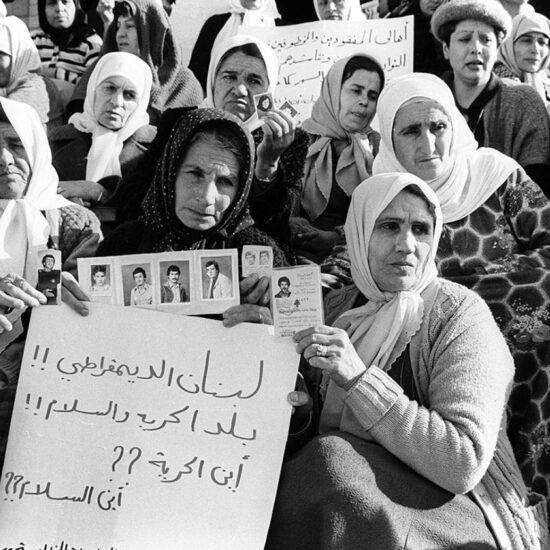

The move sparked uproar among Lebanon’s residents on Wednesday and led to several protests, blocked roads and depositors lining up in front of ATM machines to withdraw their savings before the new regulations were set to be enforced on Thursday morning.

“The central bank is not bankrupt and peoples’ deposits are safe and would be returned “soon,” said Central Bank’s Governor, Riad Salameh on Thursday.

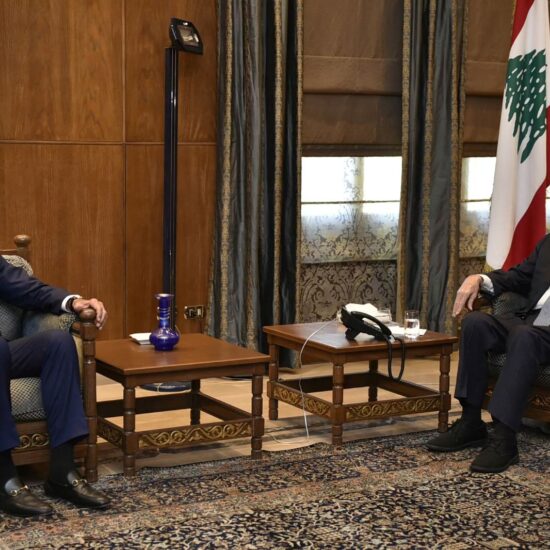

Salameh was at Baabda Palace where he met with President Michel Aoun and State Shura Council head Judge Fadi Elias.

The Lebanese State Shura Council, one of the country’s highest judicial authorities, ordered on Tuesday a temporary suspension of a Central Bank decision that allowed depositors to withdraw money at the so-called “commercial rate” of 3,900 LBP/$, while the market rate fluctuated around 10,000 LBP/$ and the official pegged rate was kept at 1500 LBP/$.

The Lebanese Central Bank announced late on Wednesday that it planned to comply with the decision of the Shura Council, but after Lebanon residents protested, the institution announced that it would discuss the matter again on Thursday.

“The situation we are in now is a reflection of the level of quandary or uncertainty that the country is going through for the last century and a half, as the political leadership was not able to come up with a real recovery plan or at least a crisis management plan.” Nasser Yassin, an associate professor at the American University of Beirut told NOW.

“What’s most visible and affecting every facet of people’s lives is the banking/ central bank crisis, this is where they have failed to address the deep crisis, they left the crisis to tools that could be effective for the short term but not on the long term. This failure, including the subsidies crisis, shows the lack of political will and how those in power are sidelining themselves by making the real decision to address the crisis,” he added.

The financial crisis has seen the local currency crashing and losing 80 percent of its value and sent half of the country’s population into poverty.

According to the latest World Bank Lebanon Economic Monitor (LEM) released on Monday, the economic and financial crisis in Lebanon is likely to rank in the top 10, possibly top 3, most severe crisis episodes globally since the mid-nineteenth century, according to the latest World Bank Lebanon Economic Monitor (LEM) released on Monday.

The Spring 2021 edition of the LEM, “Lebanon Sinking: To the Top 3,” presents recent economic developments and examines the country’s economic outlook and possible risks.