NOW Lebanon has learned that the council of ministers will soon approve a law allowing for the full dollarization of the state power supply bills at a floating rate. The invoices for electricity supply today are equated at the price of 38,000 Lebanese Pounds only. Previously, state-owned telecommunication companies Alfa and Touch, which are managed by private enterprises, dollarized their prices. The law, if approved, will be a first for Lebanese-run institutions. A proposed reform plan suggested by the four vice governors of the Central Bank of Lebanon (BDL) forecasted the need to hike revenues from taxes from 24 trillion LBP to some 280 trillion LBP monthly.

The move comes in line with a veto from acting governor of the Central Bank, Wassim Mansouri, to exchange Lebanese pounds revenues of Electricite Du Liban (EDL) to dollars to pay for fuel supplies, as he claims it will create a significant impact on the market rate. Unofficial figures say BDL owes EDL around 3.3 trillion LBP (around $37 million, according to the parallel market rate). A shipment of crude oil was forced back last year as financial authorities refused to provide liquidity for payment. It is unclear why the shipment was ordered in the first place.

Dollarized invoices will still require the approval of the state’s highest judicial authorities to decide whether the display [of prices] in national currency must be exclusive, or whether it may be combined with the display of another foreign currency.

Only two utility-scale power plants are currently operational and were temporarily shut down earlier in August due to lack of payment. Also, sources of Lebanon’s oil product shipments have changed in recent years. This has been due to both the country’s own financial crisis and global geopolitical developments that have forced the country to source its fuel needs from sellers willing to deal with a high-risk country like Lebanon.

According to figures published by the Lebanese Finance Ministry, it is estimated that between 2010 and 2020, Lebanon spent an average of $4.5 billion annually on fuel imports. In the middle of the current financial crisis, blamed on mismanagement and corruption, BDL was reportedly left with around $15 billion in foreign reserves as of March 2021, a drop from over $30 billion prior to the crisis.

With Beirut battling to pay for the plants’ fuel imports, imports of diesel for private generators have bounced, with Turkey developing as a key source of supplies.

From mid-2021 the power supply from EDL, already insufficient prior to the financial crisis, declined to an average of three to four hours a day. EDL has been a drag on the state’s budgetary resources for decades. A recent forensic audit of Lebanon’s central bank by US consulting firm Alvarez & Marcel carried figures showing that billions of dollars had been transferred to the Ministry of Energy and EDL over the decade to 2020. The figures, which were provided by BDL to show how foreign currency reserves were used between 2010 and 2020, reveal that credits in favor of EDL amounted to around $18.3 billion while direct transfers amounted to around $543 million.

The primary destinations for Lebanon’s imports of US fuel oil were two aging thermal power plants in Zouk and Jiyyeh. These inefficient plants have long run at well below their installed capacities of 607MW and 343MW respectively.

Lebanon’s financial crisis has rendered these two power plants as the only two still operating in the country, with a recent output of around 550MW according to EDL. Excluding hydropower plants, EDL has an installed generation capacity of about 2.3GW, but only around 2.0GW can be “effectively generated due to aging,” according to the Ministry of Energy and Water.

As Lebanon struggles to keep the lights on, the government has looked to Iraq to help supply it with essential petroleum products via a convoluted swap deal. However Lebanese power plants run on fuel of certain specifications which the Iraqi fuel oil does not meet. The arrangement was, in theory, expanded earlier this year to include Iraqi crude oil, which again must be swapped for products.

Meanwhile, Lebanon is operating in a global market buffeted by the fallout from Russia’s February 2022 invasion of Ukraine, with trade patterns still in flux

Prior to the onset of Lebanon’s financial crisis in 2019, the government imported petroleum products under a vague contract signed with Algerian state firm Sonatrach in 2005, which entered force in 2006. Lebanon imported the rest of its gas oil needs through a 2005 agreement with Kuwait.

The USA had been the top source of Lebanon’s fuel oil shipments between 2017 and 2020. In 2017, Beirut imported an average of around 16,000 b/d of fuel oil from US refiners, Kpler’s data shows. Volumes fell to about 10,000 b/d in 2020, before coming to a halt in 2021. European fuel oil supplies then petered out the following year

US residual fuel oil flows to Lebanon are intriguing since the small Mediterranean country could have sourced its fuel oil needs from closer refiners in the region. But US fuel oil has been priced competitively in the Mediterranean basin.

Lebanon’s power fuel imports have been dominated by diesel and gas oil, with Turkey emerging as a leading source for diesel flows to Lebanon. Both Kpler and Turkish official data indicate that in 2022 Lebanon was the top market for Turkey’s diesel exports.

The energy sector requires structural reforms that have yet to take place, and which are reportedly stalling western assistance. Despite the Ministry of Energy’s five-year plan (2022-2026) to tackle the energy sector’s myriad challenges, and other proposals to develop Lebanon’s generation capacity on a least-cost basis by pivoting the sector towards natural gas and renewables, Lebanon is expected to remain heavily dependent on fossil fuels for years to come.

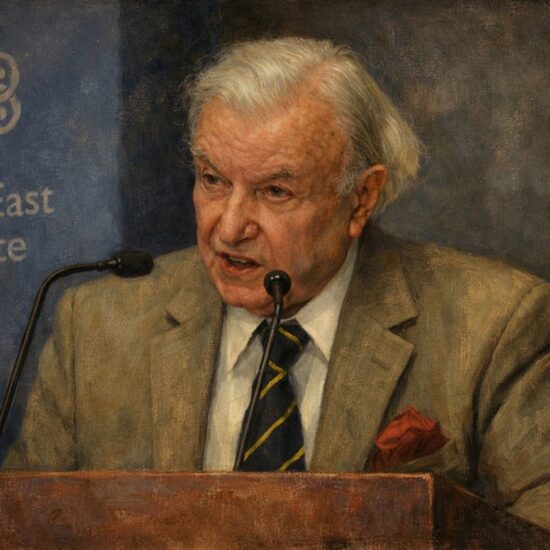

Maan Barazy is an economist and founder and president of the National Council of Entrepreneurship and Innovation. He tweets @maanbarazy.