The fifth session of AUB seminars series: “Lebanon in its Second Century: A Forward Vision,”

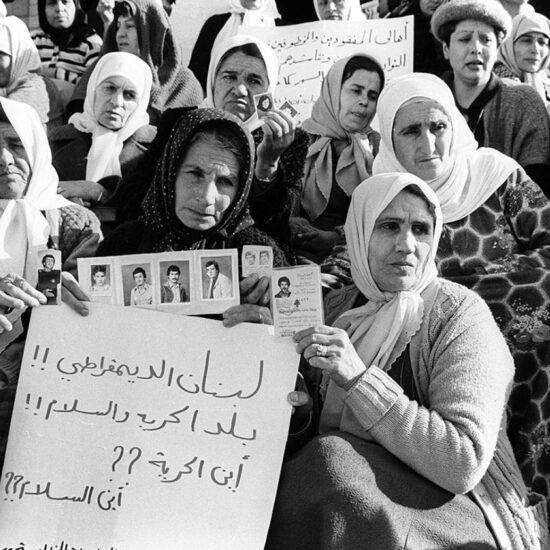

For a nation opting for a “hard default” on USD 32 billion in sovereign debt, allowing the government to evade negotiations with investors, and with depositors unable to access funds in commercial banks, and a commercial banking sector in a limbo state with a 2022 deficit of 2646.6 million in its balance of payments, the question arises: Where do we go from here in the next century? and how to reconstruct Lebanon’s productive economy will certainly raise many eyebrows and lead to different policy alternatives.

With a heavy legacy at the end of the first century of its institution, Lebanon, according to the World Bank, has experienced one of the top ten, possibly top three most severe economic collapses worldwide since the 1850s; it threatens the country’s long-term stability and social peace. The post-war economic development model, thriving on large capital inflows and international support in return for promises of reforms, is bankrupt. Public services delivery has crumbled with the Lira losing 98% of its currency value at an all-time high triple-digit inflation. In short, the country is undergoing a debt crisis, a banking crisis, a currency crisis, and a growth collapse. Four years into the crisis, a stimulus for productive sectors has been absent from any political or economic discourse.

These themes, along with efficiency, relaunching the economy, and reconstructing Lebanon’s productive sectors, were the topics of the fifth session of AUB seminars series: “Lebanon in its Second Century: A Forward Vision,” which kicked off on Nov 1 and will stretch to March 2024. The panel looked at leveraging the economy through its industrial and agriculture sectors as well as an ideal business environment for growth.

For many countries under distress, rebuilding a viable commercial milieu and a vibrant business environment backed by incentives are key for inciting growth, a headline shared by the panel’s speakers.

Banking on Human Capital:

Aliaa Moubayyed, Senior Economist

Top on the agenda was the need to foster a viable business sector catalyst and trigger productive sectors, a theme underlined by moderator Aliaa Moubayyed, a senior economist who quoted that “there is a need to invest in the still available resources left in the country, mainly human, financial capital, and infrastructure.”

According to Moubayyed, “the main trigger for the economy to prosper is to regain human capital and invest in the substantial inventory of competitive labor force that productive sectors can rely on.” Is the presence of labor enough to speed investments?

She believes that “the Lebanese diaspora possesses a network of relationships that can be leveraged to sponsor a shift from a rentier-based economy to a productive one.” “Unfortunately, the infrastructure has become inappropriate for investment. Public policies that enhance competitiveness to make the productive economy attractive for private investment are absent,” she added.

Building a Competitive Business Environment:

DR. Wael Mansour, Economist

The discussion in the first session revolved around the components of a productive economy and its pillars. Economist Dr. Wael Mansour underlined the need for Lebanon to build a competitive business environment. In fact, Mansour’s view is not strange to the policies of international organizations such as the World Bank and the IMF.

Different opinions do believe that competition law and policy can be seen as just a broad set of policy tools required to create an efficient market economy; however, bringing about the best business environment and a competition law cannot be considered in an isolated manner to create growth. The narrative that modern commerce laws can guarantee that markets will function effectively needs to underline that a range of other government policies conform to basic market principles obtain. Government policies would be trade policy, industrial policy, privatization, deregulation, regional policy, and social policy—all need to be conducted in a manner compatible with the market mechanism for an economy to function as efficiently as possible.

In the first century of its institution, Lebanon has been a rentier-based economy – can a shift to a productive model obtain in the next century?

True to say that a productive economy underlines the need to reduce the cost of doing business while improving the overall business environment which will lead to a raise in Lebanon’s competitiveness levels. “For the last century, Lebanon relied on a doomed model of a rentier-based economy which relied on surplus income generated without additional effort or production costs. This typically arises when there are cases of monopoly, oligarchy, or privileges granted to one group over another,” Mansour said.

A growth model needed in the second century would be focusing on efficiently and effectively producing goods and services, characterized by sustainable growth, job creation, reliance on innovation, technological development, skills, and, most importantly, a competitive business environment.

According to Mansour, it is feasible to restore the size of the Lebanese economy to pre-crisis levels by 2040 and achieve growth rates comparable to those of countries with higher middle-income levels, based on solid foundations of increased production and exports with reduced consumption. A second pillar to Mansour’s model would be to export goods and services rather than exporting labor and skilled workforce, to restore the size of the economy to its 2018 level, which was USD 55 billion, after it declined during the crisis to less than half, some USD 23 billion.

Mansour outlined a model for a productive economy based first on a fiscal policy that gives incentives to investment by imposing higher taxes on rentier-based income rather than on wages. Also, the model would require focused government spending on sectors that support production, such as electricity, the internet, and education. Additionally, the model requires a monetary policy that will end banking monopolies to finance the economy, introduce new players to the Lebanese market, set limits to the Central Bank’s speculation that supported sectors and monetary policies. On a wider scale, there is a need to re-evaluate external trade agreements involving the service sector, a competitive business environment achieved by abolishing all monopolistic laws like the Exclusive Agencies Law, enacting anti-trust laws with efficient regulatory bodies for enforcement, stimulating private sector involvement and state participation in investment, and supporting startups. All of this needs political will for change and competent institutions capable of implementation. Needless to say, the current state of affairs of Lebanon’s public sector doesn’t look ready for these scenarios.

The model designed by Mansour is unfortunately typical of a scenario the World Bank uses to address failing economies; however, it doesn’t take into consideration the current corrupted state of affairs of Lebanon’s governance nor the vacant public administration, which is creating a hurdle on all.

Mostly there is a priority need for bank restructuring as the insolvency of the commercial banking system is causing a paralysis for the economy as a whole. Four years of negotiations have not helped a banking restructuring law to see the light.

The Case for the Lebanese Industry:

Paul Abi Nasr, a board member of the Lebanese Industrialists Association

Another growth model under scrutiny would be the industrial sector, which witnessed many success stories in the 90s. Can this sector create a leverage effect for the economy and henceforth be a winning horse in the race for development? The design of an overall strategy for industrial development is key for the next century. Such a strategy would include vocational training, geographical distribution of factories to suit industrial needs, the integration of all economic sectors, as well as encouraging closer interaction between the industrial sector and research institutions. A viable industrial sector will never be realized in Lebanon if the industry does not progress according to current worldwide technological developments and guarantees of sales markets.

This was the subject of the second session, which focused on the ins-and-outs of the sector and was addressed by Paul Abi Nasr, a board member of the Lebanese Industrialists Association.

Abi Nasr’s model relies on the full liberalization of the sector with a minimum of state interference. “There is a need to bank on the values of our liberal system and pave the way for companies and the private sector to thrive and grow independently from any government interference,” he said.

The model he proposed is one that will bridge the gap between productive and industrial decentralization to establish a connection between individual creativity and the industrial sector to work harmoniously and deliver innovative products and varieties into the market. Yet to take Abi Nasr’s account seriously, all this underscores the absence of an official industrial policy, as well as the lack of a clear strategy for Lebanon’s overall economic development. To be noted, this gap in policy and strategy has been filled by random improvisations in decision-making concerning all aspects and dimensions of the industry in Lebanon. Needless to say, that top on the reinvigoration of the sector there is a need for establishing industrial districts, studying the financing of the industrial sector, and rehabilitating the Institute for Industrial Research and Industrial Credit if the sector needs to be marked as key for creating a leverage effect in the economy.

According to Abi Nasr, the focus should be on creating a fostering environment that will thrive in educational and infrastructural levels and simultaneously align with Lebanon’s liberal policy and geographical nature, hence the need for an exceptional decentralized system for preferential growth and fragmented solutions. Key to this endeavor would be pinpointing the preferences of industrial production to compete regionally and internationally. To be noted, Lebanon’s exports are inhibited by three factors (outside of the crisis itself): (i) (pre-crisis) economic fundamentals; (ii) global conditions; and (iii) political/institutional environment.

An Agricultural Model?

Nizar Ghanem, Research Director at Triangle Foundation

The final session centered on the agricultural industry, covering food and pharmaceuticals, addressed by Nizar Ghanem, Research Director at Triangle Foundation. He emphasized that the agricultural economy can have a significant share of the Lebanese economy, increase its export and capitalize on the potential for improvement in this sector. According to Ghanem, the state’s investment in the sector accounts for only 0.5 percent of its general budget. Hence, substantial reforms and investments are needed in key sectors such as the pharmaceutical market and Lebanon’s agri-business sector.

“All cartels in this field need to be dismantled, and Lebanon needs a clear trade policy to enhance its products for entry into European, American, or other markets. It’s unacceptable for there not to be an improvement in overall quality, port regulation, comprehensive reform of currently ineffective agricultural cooperatives, and many other issues,” he quoted. The comparative potential is certain, comparable to countries like Italy or Turkey,” he said.

Maan Barazy is an economist and founder and president of the National Council of Entrepreneurship and Innovation. He tweets @maanbarazy.

The views in this story reflect those of the author alone and do not necessarily reflect the beliefs of NOW.