Despite timely preparation, Lebanon’s proposed state budget for 2024 faces criticism for its regressive tax policies and lack of transformative economic reforms.

The Lebanese Parliament, as an achievement, convened to discuss the proposed 2024 state budget on schedule in late January. The session began around 11 a.m. on January 24 . The draft budget, consisting of 96 articles, underwent review but was still under heavy criticism.

Initially crafted by the Minister of Finance during the summer, the preliminary draft was subsequently reviewed and amended by the Council of Ministers. After consensus among ministers, it was sent to Parliament for further examination by the Finance and Budget Committee.

During the parliamentary session, significant debate revolved around the government’s plan to boost revenue primarily through regressive indirect taxes like VAT, placing the burden on the country’s poorest citizens. Additionally, the draft included measures targeting entities that had profited unfairly from the central bank’s policies during Lebanon’s financial crisis, proposing fines for companies and traders who exploited the system for personal gain.Experts express skepticism regarding the 2024 budget draft, citing its resemblance to the previous year’s version and its failure to implement necessary reforms outlined in its preamble. Contrary to expectations, the draft does not prioritize investment in public services or address the need to rebuild Lebanon’s fractured social contract. Instead, it is anticipated to exacerbate the country’s economic woes and worsen the plight of its impoverished population. Despite being prepared in a timely manner, the draft lacks the transformative measures needed for positive economic impact.

“It is just business as usual,” Walid Marrouch Professor of Economics and the Assistant Dean of Graduate Studies & Research at the Lebanese American University (LAU) told NOW. “This new budget still has the spirit of previous budgets.”

Nothing new

The 2024 budget introduces a regressive tax system, neglecting to address the interdependence between expenditure, revenue parameters, and crucial macroeconomic objectives necessary for sustainable growth. Notably, it withdraws key provisions that could have supported the formal private sector amidst economic collapse. Articles 56 and 57, which previously exempted businesses from taxes on asset and stock re-evaluation due to exchange rate differences, along with Article 93 concerning end-of-service calculations, have been revoked.

Additionally, the budget includes measures targeting those who profited illicitly during Lebanon’s financial crisis, imposing fines on companies that exploited the central bank’s currency exchange platform and traders who profited from import subsidies. Concerns persist regarding the state’s ability to enforce compliance due to weakened tax administration and a prevalent cash-based economy, raising doubts about the effectiveness of these policy changes.

Despite expectations, direct taxation is projected to generate $780 million, with the budget retaining the same flawed income-tax bracket as the previous year, resulting in inadequate taxation of high earners and excessive taxation of vulnerable individuals. The Policy Initiative think tank criticizes the budget for disproportionately burdening middle and lower-income households compared to the affluent, citing measures such as lowering the VAT threshold for businesses and offering tax exemptions to large corporations.“The budget’s numbers are unrealistic,” Marrouch stated. “It claims to be a deficit-neutral budget, which is untrue because the revenue projections are merely theoretical or wishful thinking.”

Regarding tax increases during economic hardship, Marrouch advises caution, citing the Laffer Curve, which suggests an inverse U-shaped relationship between the effective tax rate and collected government tax revenues.

Laffer recommends increasing tax revenues by lowering tax rates when the economy is the context of the downward-sloping part of his curve, a likely scenario when the macroeconomic situation is challenging.

“The draft appears to be an accounting exercise rather than an economic policy plan” Marrouch remarked, highlighting numerous unaccounted factors such as the compliance with the existing tax system and the ability to collect taxes etc.

A slowed recovery

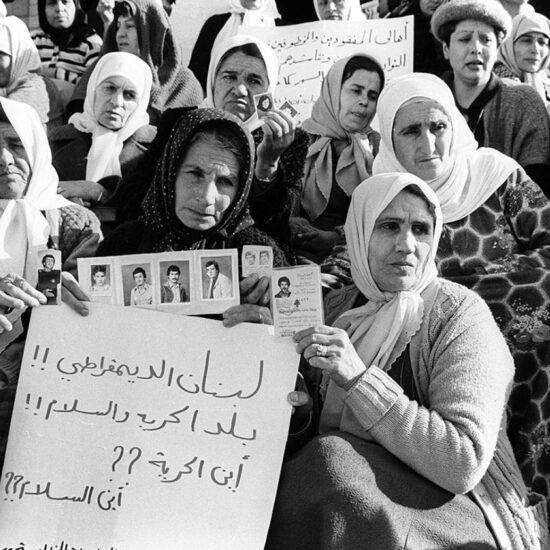

Since 2019, Lebanon’s economy has deteriorated drastically, with the currency plummeting by approximately 95% in value. Most depositors have been unable to access their savings due to bank restrictions, pushing over 80% of the population below the poverty line.

Prime Minister Najib Mikati claimed asserted that the government has halted the ongoing collapse and initiated the recovery process. However, his statement faced opposition from many members of parliament, with around 40 requesting to voice their objections during budget discussions.

“Lebanon’s recent recovery was primarily attributed to the economy’s dollarization last year,” Marrouch noted. “With the shift to the dollar, both consumers and businesses gained clarity regarding their cost of living and revenue management.”

He asserts that the government played no significant role in this improvement.

Marrouch adds that the recovery may have been hindered by the Israeli war on Gaza, which adversely affected Lebanese tourism, a key contributor to the country’s economic growth.

Dr. Patrick Mardini, CEO of the Lebanese Institute for Market Studies, told NOW that the need for better control over government expenditure, pointing out that the budget increases government spending by 50%. He suggested implementing a spending cap tied to economic growth to prevent arbitrary expenditure hikes.

Regarding any claimed recovery, Mardini expressed skepticism, noting that while a slight growth of 1.7% is projected for 2024, it falls short of true economic recovery.

One of the main challenges Mardini mentioned is the method of financing the budget, warning against returning to inflationary practices such as printing money, which could exacerbate poverty and reduce income.

Mardini also criticized Lebanon’s lack of reforms, particularly in opening up sectors like the electricity market to competitors, which he believed could stimulate development.

“Opening up these sectors for competition would have allowed better development for the government,” Mardini stated, adding that the government’s monopoly over these sectors and its inefficient allocation of budgetary resources hinders economic development.

Marrouch observes that the country requires capital investments to facilitate the circulation of dollars in the economy and spur growth.

“Another concern is the budget’s ambiguity regarding exchange rates,” Marrouch added, highlighting an unusual aspect of the budget process.

Both experts agreed that the budget would impose a negative financial burden on the population, particularly amid looming war and insecurity. However, in a country with constant governmental neglect and absence, the budget reflects its proprietors: inconsiderate and ineffective.