Foreign express interest in a thirsty market and demand guarantees

There has been more political maneuvering in the banking system and depositors’ crisis as NOWLEBANON has learned that the political junta is pushing towards a French mediation for the default on Eurobonds and a possible merger and acquisition move from French banks. The intertwining relationships and political influences within Banks underscore the complex web of connections that often exist between banking institutions, political figures, and decision-makers in Lebanon. There is a massive overlap between the country’s political class and those with financial interests in the banking sector. Indeed, as this report reveals, a quarter of all board members of Lebanon’s biggest banks meet the internationally recognized definition of a politically exposed person (PEP), meaning someone who either holds or has held a prominent public function, or family members and close associates of such people. The Financial Action Task Force (FATF), which heralds itself as “the global standard setter on combating money laundering and the financing of terrorism”, defines a ‘politically exposed person’ (PEP) as someone who is generally entrusted with a prominent function. FATF says a common feature among PEPs is their capacity to abuse their positions “for the purpose of laundering illicit funds or other predicate offences such as corruption or bribery”, though this capacity does not necessarily entail that a PEP actually does engage in nefarious activity.

An example of the apparent conflicts of interest this can create was recently on display after Ghada Aoun, Attorney General at the Mount Lebanon Court of Appeal, filed charges of money laundering against Bank Audi, Société Générale de Banque au Liban (SGBL) and their senior leaders in February. Bank Audi is Lebanon’s largest lender, with assets in excess of LL40 billion, according to the Association of Banks in Lebanon’s (ABL) 2022 Almanac, whilst SGBL is the country’s third largest bank. Shortly after Aoun filed her charges, caretaker Prime Minister Najib Mikati intervened in the case, asking the interior minister to block the security forces from carrying out her orders. Mikati claimed that Aoun had overstepped her legal authority, while Lebanon’s Higher Judicial Council claimed Mikati had infringed upon the independence of the judiciary. Notably, among the many PEPs who are directors and shareholders at these banks is the caretaker prime minister’s own brother, Taha Mikati, who holds a 2.3 percent stake of Bank Audi.

Lebanon remains in restricted default (RD) on its foreign-currency (FC) debt, following the sovereign’s failure to pay the principal on the Eurobond that matured on 9 March 2020. The government has stopped servicing its outstanding stock of Eurobonds pending a restructuring. Lebanon’s disorderly default on Usd 31.3 billion of sovereign Eurobonds in March 2020 was preventable but detonated as a result of the usual mix of personal greed, outright incompetence and the corrosive manipulation of powerful foreigners. On March 16 2020, Lebanon defaulted on a Usd 1.2 billion Eurobond.

It also fails to fully articulate the ruthlessness and greed of Lebanon’s banks both before and after the default. Pushed by top management and their largest depositors – both hungry for cash to flee a deepening national crisis – the banks did not hesitate to sell Eurobonds into foreign hands, knowing perfectly well that doing so would severely weaken the government’s negotiating position and hamper the prospect of a debt restructuring.

A French “solution” to Eurobonds default

NOWLEBANON sources confirmed that prime Minister Mikati in his last visit to France urged French president Emanuel Macron to lobby French bankers to “look at opportunities” in the ailing banking system either through mergers or acquisitions. According to informed sources, Prime Minister Najib Mikati has requested assistance from French President Emmanuel Macron to help end Lebanon’s cash economy by introducing foreign banks into Lebanon. A source in the Depositors Union confirmed that Mikati’s logic, along with Acting Governor of the Central Bank of Lebanon, Wassim Mansouri, is that meeting escalating American pressure to end the cash economy leaves no choice but to revive the banking sector. Also under the microscope are behind closed doors negotiation to hike the dollar rate used for trade ( know as the Custom Dollar ). There has been previously an announcement by the caretaker government that a new rate will be determined before the end of May.

The Eurobonds default was a “big short” for some banks. Reports say that Bank Audi was very likely the single biggest seller between October 2019 and March 2020. Unlike most Lebanese banks, Audi must file periodic reports since it is traded on the Beirut Stock Exchange. While most banks simply stopped publishing meaningful data after October 2019 to cover their tracks, Audi continued reporting. According to Audi’s 2020 Annual Report, it held almost US$2 billion in Eurobonds on January 1, 2020. Fully aware of the difficulties for the Lebanese government, the bank nevertheless sold “the vast majority of [our] Lebanese Eurobonds exposure” so that by the end of June 2020 Audi held a mere US$57 million in Eurobonds.

It is very likely, however, that Audi sold the vast majority of its Eurobonds to foreigners before the default in Q1, when prices for the bonds were higher, as the selling of Eurobonds substantially slowed in the three months after the default. Audi’s subsequent 2021 Annual Report obliquely states it disposed of “the majority of [our] Eurobonds during Q1-2020 the sources say.

In all cases, Audi’s selling of almost US$2 billion in Eurobonds in early 2020, even in the unlikely event that some sales were made as late as June, represents more than 55% of the total amount of Eurobonds sold by all Lebanese banks to foreigners during the first six months of 2020 the sources added.

According to several industry insiders, the Eurobond sell-off during the first months of the crisis by Audi and several other banks was specifically driven by the narrow desire of top managers, big shareholders and ultra-wealthy depositors to gain “fresh cash” and transfer it abroad to escape the financial “death spiral” they had long seen coming. As the Banking Control Commission noted in its confidential report of February 2020, the extra dollars also helped individual bankers and large depositors protect their international reputations by paying back individual and institutional commitments.

Deleveraging the cash economy

In 2022, the World Bank estimated that the cash economy was worth close to Usd 10 billion, or over 45% of Lebanon’s GDP, a trend that is likely to persist, if not increase, as the population continues to distrust the banking system. A US treasury mission was in Beirut earlier to inquire abiut the size of the cash economy. In a good gesture move Acting Governor of the Central Bank of Lebanon, Wassim Mansouri, decided to allow taxpayers (individuals and institutions) to pay their taxes using electronic payment cards, by utilizing their deposits in banks. He has begun technical procedures to facilitate this process. Concurrently, the Development and Liberation Bloc decided to assist Mansouri in his mission by preparing a draft law regulating tax payment operations using cards. The law will soon be presented to the parliament. However, this project requires determining the exchange rate of the dollar for withdrawals.

Foreign banks need a solution for default

Since Lebanon has difficulty implementing the “reforms” requested by the International Monetary Fund, notably the banking sector restructuring law, the scope of the search is narrowed to a shorter route involving the introduction of one or more foreign banks into Lebanon. Notably those need guarantees related to two things: unifying the exchange rate to ensure and protect their capital and investment in lending and financing, and resolving the external debt issue (Eurobonds) that allows Lebanon to return to the international market and sustain public debt. In this context, a formula has been proposed where Lebanon – through a third party that may be a foreign bank – negotiates with foreign Eurobond holders to buy their bonds or part of them, for Lebanon’s account or for the foreign bank’s account, for an amount of up to Usd 3 billion, alongside the foreign bank initiating negotiations to purchase viable local banks after bond prices rise.

Sources confirmed to NOWLEBANON that foreign banks have expressed interest in the Lebanese market, viewing the banking insolvency as an opportune and inexpensive investment in a thirsty market. Undoubtedly, they are betting that conditions in Lebanon will not remain as they are, and that regional conditions will return to some form of stability sooner or later. However, they are also betting Usd 3 billion that Eurobond prices will rise after the banking sector is revived, allowing them profits from bond purchases. This investment is a political one, making the bet on French political success rather than stability in the market. Practically, the guarantees will be sovereign in nature. This is not the only obstacle to this plan. The issue of unifying the exchange rate, including the so-called “bank dollar” and issuing legislation to protect “fresh” dollars, is not easy as long as it is linked to the rights of depositors who only receive Usd 400 monthly from some of their deposits, while others receive Usd 300 and yet others Usd 150. The discrimination between deposit dollars to be accounted for by banks at a rate different from loan rates is not trivial for foreign banks, which see it as an obstacle related to audit reports and their global reputation. For foreign banks, the need to unify the exchange rate is tied to a wide range of investment operations they will undertake in Lebanon, including lending in the market, buying stocks and bonds, in addition to the necessary legal guarantees in this case.

In any case, it seems that technical arrangements have moved quickly towards this closure that has been stuck since Lebanon stopped payments in March 2020. According to available information, Mikati is trying to hint at French approval of this proposal, and working to accelerate the legal and financial work in cooperation with former Minister of Labor Camille Abou Sleiman, who is knowledgeable about Eurobond issuances and their contract clauses, as well as with Acting Governor of the Central Bank of Lebanon Wassim Mansouri, who is reportingly also coordinating with Abou Sleiman. The latter is a partner in a law firm in the United States specializing in financial matters and has represented the Lebanese state in Eurobond issuances, as well as representing the Central Bank of Lebanon in recent lawsuits filed by depositors against it in the United States.

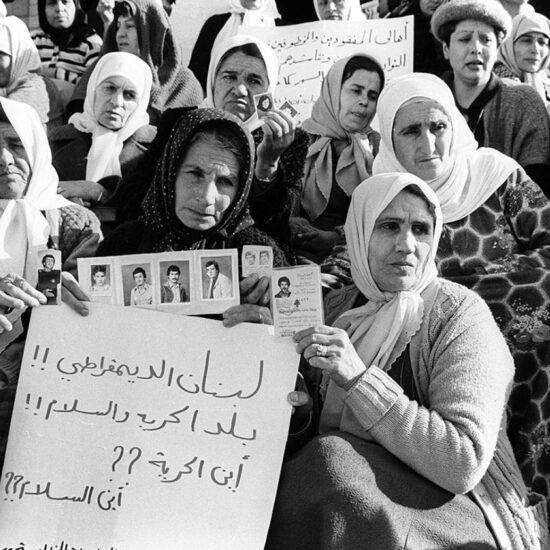

While banks in Lebanon, since the start of the crisis in October 2019, have imposed an illegal “freeze” on Lebanese deposits preventing people from withdrawing money in dollars, and transferring money abroad, Lebanese bankers, politicians and senior businessmen did transfer their money abroad. The close connections between politicians and banks raise concerns about transparency, accountability, and the integrity of the financial sector in the country. Addressing these issues is crucial to ensuring a fair and ethical financial system that serves the interests of all Lebanese citizens

The Lebanese model is considered unique in terms of overlapping interests, as there are politicians who own banks, politicians who are shareholders in multiple banks, and bankers who have taken on public affairs as ministers, deputies, or judges. There are even politicians who own companies providing public services.

A political leadership of ABL

There is a collaborative solidarity relationship between politicians and bankers that dates back decades. The close partnership between the banking sector and the political authority goes beyond contributions, cooperation, and the like, reaching the level of real partnerships, kinship relationships, share purchases, and the establishment of joint ventures inside and outside the country.

Through the close interconnection between bankers and politicians, the power of the Association of Banks of Lebanon ( ABL ) banking surpasses both the legislative and executive authorities denoted in close connections of elected presidents of the ABL. The late Raymond Audi (Bank Audi) assumed the presidency of the association in 1993 and later took on ministerial duties in the government of Fouad Siniora in 2008 as part of the March 14 Alliance. Farid Raphaël (Banque Libano-Française) assumed the presidency of the association in 1997 and in 1999 held the positions of Minister of Finance, Minister of Justice, and Minister of what was previously known as the Ministry of Electricity, Post, and Telecommunications in the government of President Sleiman Frangieh. Joseph Torbey (Bank of Beirut) assumed the presidency of the Association of Banks in 2001, 2003, 2009, 2011, and 2015. He was the head of the income tax department at the Ministry of Finance from 1970 to 1988, and the president of the Maronite League from 2007 to 2013.

As for the members of the Association of Banks, a large number of them have held high political positions, especially since 18 of the major banks are owned by former or current politicians, or by individuals affiliated with political families. This indicates that the relationship between the two parties is controlled in one way or another by political decisions in the country. This also explains the reasons why banks evade their responsibilities towards depositors and are protected by successive governments and the legislative and judicial authorities.

Banks allegiances

Following the late Minister Raymond Audi, Samir Hanna assumed the chairmanship of the bank’s board of directors. Hanna, a banker closely associated with Riad Salameh, was involved in the financial engineering crime that the World Bank considered a precursor to the financial collapse. The name of Bank Audi and Samir Hanna appeared in the case involving Riad Salameh, his son, and brother, accused of corruption and money laundering. Samir Hanna, against whom a warrant was issued for breach of trust, fraud, and financial insolvency, has an extensive network of businesses in the country that defy description and span multiple sectors. His business activities have expanded to include his son contracting through his company with most banks, and his son-in-law serving as the executive director of Bank Audi, benefiting from support funds through his companies. In addition to Bank Audi’s connection to a company owned by Riad Salameh’s son, which processes most of its suspicious financial operations in Europe, the bank has shareholders closely tied to prominent political figures. These include Fahd Hariri, the brother of Saad Hariri, and Taha Mikati, the brother of Najib Mikati. Mikati has demonstrated his allegiance to the bank by fiercely defending it and standing against Judge Ghada Aoun in the case brought against the bank for money laundering and illicit enrichment. Mikati bought all the credit card business of Audi to provide for capital as the bank was the fiorst to receive billions in financial engineering. Bank Audi has examples of conflicting roles within its governance structure. Board member Farouk Mahfouz, a former member of the Banking Control Commission and representative of the National Deposit Guarantee Institution, raises concerns about regulatory oversight and potential influence within the bank.

SGBL Bank, another bank has been involved in undermining proposed solutions to the financial crisis that has been ongoing for years, simply because these solutions conflict with the interests of major bankers who hold decision-making power in the parliament. Antoine Sehnaoui, the chairman of the board of Societe Generale de Banque au Liban (SGBL), is the nephew of the bank’s founder in Lebanon, Antoine Michel Sehnaoui, who served as the Minister of Posts, Telegraphs, and Telephones ( currently Telecommunication Ministry ) in the mid-1960s. He is also the cousin of Nicolas Sehnaoui, a former member of parliament and minister of telecommunications, and the son of Nabil Sehnaoui, who currently serves as a board member in the same bank.

Antoine Sehnaoui, who also holds a second seat on the bank’s board as a representative of a joint-stock company, has been actively involved in parliamentary elections, supporting electoral lists in various regions of Lebanon including Georges Akiki, Jean Talouzian, Nadim Gemayel, and Raji Saade, with whom he has a family connection.

Moreover, Sehnaoui has a special relationship with Nader Hariri, the son of MP Bahia Hariri and former director of Prime Minister Saad Hariri’s office. Sehnaoui’s relationships extend beyond politicians to judges. Judge Charbel Abou Samra, who has presided over multiple cases involving Sehnaoui, is related to MP Talouzian, who is affiliated with Sehnaoui. MP Talouzian is the husband of Judge Abou Samra’s sister, who also holds an administrative position in Societe Generale Bank

BBAC, is another instance, it has Deputy Chairman of the Board of Beirut and Arab Countries Bank, Judge Abbas El-Halabi, who also served as Minister of Education and Minister of Information between 2021 and 2022. Another board member is Amin Rizk, the son of the late MP and Minister Edmond Rizk. This overlap of roles raises questions about the separation of powers and potential conflicts of interest within the bank.

IBL, led by former MP Salim Habib, counts active or former political figures among its shareholders, such as former MP Eli El-Ferzli and the late former MP Mohammad Baydoun. The involvement of these political figures in both the bank and political spheres blurs the lines between banking and politics, raising questions about undue influence and favoritism.

Bankmed, associated with the late Prime Minister Rafik Hariri and his family, includes former Minister Raya Haffar Al-Hassan and Nazek Hariri on its board of directors. The ownership of the bank by the Med Holding Group, responsible for managing the investments of the Hariri family, further highlights the close ties between politics and banking in Lebanon.

Marwan Kheir el-Din, the director and chairman of Bank al-Mawarid, is a member and co-founder of the Lebanese Democratic Party. He previously ran for parliamentary elections on the lists of the Shiite duo and received unlimited support on all fronts but was defeated. However, his relationship with the political authority does not stop at his political ambitions and party affiliations. Kheir el-Din served as a minister between 2011 and 2014 and has a family relationship with the politician Talal Arslan. The latter’s wife is Kheir el-Din’s sister. Family ties extend beyond the Arslan circle as Kheir el-Din’s mother is the sister of the former deputy and minister Anwar Khalil, supported by the Amal Movement.

In addition to Kheir el-Din on the board of Bank al-Mawarid, there is Majid Jumblatt, the former deputy governor of the Central Bank of Lebanon. He also has a family relationship with Arslan as Jumblatt is the husband of Arslan’s sister. The bank’s board also includes Ibrahim Hanna Daher, a former state minister for administrative development (2004-2005).

Kheir el-Din has been cited by the pandora papers as director of two British Virgin Island-based companies.

The Pandora papers

More examples of bad governance and fraud were disclosed in the Pandora papers. Prime Minister Najib Mikati features in the documents, which reveal that the politician and billionaire businessman purchased a Usd 10 million property in Monaco in 2008 via a Panamanian company he owned. Mikati’s son Maher was the director of at least two British Virgin Islands-based companies, through which the M1 Group owned a property in London. In a statement to ICIJ and their Lebanese partner, Daraj, Maher said that Lebanese nationals use Panama and BVI-based companies “due to the easy process of incorporation” and not to evade Lebanese taxes. Former Premier Hassan Diab is also present in the documents as part-owner of a shell company in the British Virgin Islands alongside businessman Nabil Badr and financier Ali Haddarah.

Banque du Liban governor Riad Salameh founded a company called AMANIOR in 2007. Article 20 of the Code of Money and Credit says that the central bank governor is “barred from keeping, taking or receiving any interest whatsoever in a private enterprise.”

Maan Barazy is an economist and founder and president of the National Council of Entrepreneurship and Innovation. He tweets @maanbarazy.

The views in this story reflect those of the author alone and do not necessarily reflect the beliefs of NOW.