Despite a change of guard and of policy at the Central Bank of Lebanon (BDL), rating agencies filed negative sentiment scenarios last week underlining the lack of reform policies at the financial level and a failure to meet requirements for a broader monetary policy and restructuration of the banking sector, stressing the need for a deep haircut of deposits to reach a level of debt sustainability.

While Fitch Ratings, a leading provider of credit ratings, commentary and research for global capital markets, has revised the Country Ceiling for Lebanon to ‘CCC+’ from ‘CCC’, reflecting the updated Country Ceiling Criteria they published in July 2023, Goldman Sachs published a report on Lebanon titled, “Change of guard at BDL does not bring resolution to economic crisis any closer” addressing the need for broader reforms. Political authorities are turning a deaf ear to the much-needed urgency of reform called for by many international agencies and watchdogs.

S&P Global Ratings also published an update affirming its long- and short-term foreign currency ratings on Lebanonat ‘SD/SD’ – meaning Suspended/Default – indicating a failure to meet ratability standards. They also affirmed their long- and short-term local currency ratings at ‘CC/C’. The outlook on the long-term local currency rating remains negative. The Transfer and Convertibility (T&C) assessment on Lebanon remains ‘CC’. These ratings indicate very low credit quality and a high level of credit risk.

S&P action follows the Fitch Ratings update affirming Lebanon’s Long-Term Foreign-Currency (LTFC) Issuer Default Rating (IDR) at ‘Restricted Default’ (RD). Fitch has also downgraded Lebanon’s Long-Term Local-Currency (LTLC) IDR to ‘RD’ from ‘CC’ and the Short-Term Local-Currency (STLC) IDR to ‘RD’ from ‘C’.

Fitch says that its key rating drivers are still influenced by a Eurobond Default. Thus, Lebanon remains in RD on its foreign-currency government debt, following the sovereign’s failure to pay the principal on the Eurobond that matured on 9 March 2020. As for Fitch under its revised criteria, the Country Ceiling floor is ‘CCC+’, which is applied when transfer and convertibility risks have materialized. In Fitch’s view, capital and/or exchange controls that are preventing the private sector from converting local currency into foreign currency and transferring the proceeds to non-resident creditors to service debt payments have been imposed. These are impacting the vast majority of economic sectors and asset classes.

Fitch underlined that the BDL’s LC debt holdings is still not serviced: The LTLC and STLC IDR downgrades to ‘RD’ reflect that the government is not paying interest on the Central Bank’s holdings of local-currency securities issued by the government, Fitch said.

On a positive note, the BDL announced a halt to funding government deficits in both LBP and USD. The new policy underlined that BDL will no longer fund or monetize budget deficits both in LBP and USD; the government has to fend for itself by increasing and widening tax collection, re-opening striking government departments, closing unlawful border and port crossings, and exacting more effective control over its lawful ones. In a move to push more reforms, acting Governor Wassim Mansouri criticized the government’s complete inaction on reforms, which are severely hurting economic growth and stability, encouraging the cash economy, and causing further isolation of Lebanon in international markets and institutions. However, those actions have not raised any positive mention in the reports.

In addition, Goldman Sachs showed that debt sustainability requires a deep haircut of 80 percent or a recovery value of 20 cents per USD and at a coupon rate of 12 percent And, assuming growth of 5 percent and nominal interest rate of 6 percent, in addition to an exchange rate of 65, 000 LBP, the debt to GDP can accordingly fall from 350 percent in 2022 to 50 percent in 2032.

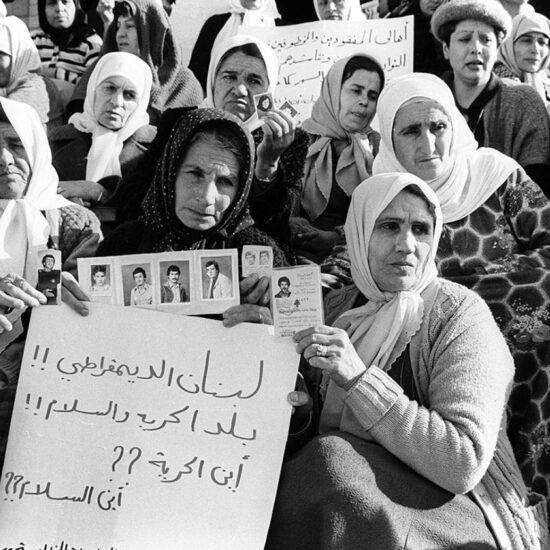

More broadly, the report argued, “it is unlikely in our view, that material progress can be made on many of the prior actions required by the IMF, given their politically sensitive nature.” No single prior action illustrates this more than the requirement to pass a “Gap Resolution and Capital Restructuring Law” to address the bank losses. Those amount to around $65 to $70 billion approaching four times GDP. How these losses will be distributed between the government, bank shareholders, and depositors is a highly contentious question, it added.

More importantly, Goldman Sachs’ analysis was mainly pessimistic, as it highlighted that there is still no political resolution in sight. “Despite improving prospects after the restoration of diplomatic ties between Saudi Arabia and Iran, the political impasse continues to delay already lagging reform efforts and progress on IMF prior actions; and despite that some incremental progress possible under interim BDL Governor Mansouri, particularly on floating FX regime,” the report stated.

The report concluded on a pessimistic note, stating that “Lebanon’s path to economic recovery is thus a long one, beginning with the election of a new president, the formation of a new cabinet, and the subsequent agreement of all political factions on a reform agenda. Only then, and assuming the reform agenda conforms with the IMF’s requirements, would this clear the path for an IMF program and the crowding in of funding in the form of concessional lending and grants from Lebanon’s partners, including multilateral agencies, the Gulf and Europe. At this point, we could also see a resolution to the defaulted Eurobonds. Putting a time frame on this is extremely difficult, but our best guess is that it is highly unlikely to occur in the next 12 months”.

At present, the reform program, although strongly stressed by creditors as a sure call to improve investor confidence in the system, requires the restructuring of the banking sector. With no prospect for the government to recapitalize the banks, a bail-in of depositors will likely be required in order to restore viability to the banking sector. Until now, however, all of this is just wishful thinking.

Maan Barazy is an economist and founder and president of the National Council of Entrepreneurship and Innovation. He tweets @maanbarazy.

The views in this story reflect those of the author alone and do not necessarily reflect the beliefs of NOW.