The meandering 2024 journey of Lebanon's zombie banks: A 70% core capital Loss and shifting ownership dynamics

A key element of the upcoming economic stimulus lies in the necessity to revamp Lebanon’s financial sector, enact the law for deposit restructuring, and reform the Lebanese banking sector. The Progressive Deposit Recovery Plan, entangled in political intricacies, is at the heart of these initiatives. Analysts emphasize that 2024 is the final opportunity for the law to be effective before a complete system erosion results in changing shareholders.

Navigating Challenges: Political Resistance and Financial Disparities

Lebanon’s political circles resist restructuring due to inherent conflicts of interest amid a profound financial crisis. The precise evaluation of banks’ current assets and liabilities reveals a staggering $80 billion financial gap. Determining accountability for this gap is pivotal.

Current law versions harbor ambiguities fostering loopholes, haphazard implementation, and, significantly, conflicts of interest.

Deposit Recovery and Insolvency

Lebanon’s insolvent banking sector necessitates significant consolidation and restructuring to address longstanding macroeconomic weaknesses for successful rehabilitation from the ongoing financial crisis. The Progressive Deposit Recovery Plan (PDRP) initially promised immediate full restoration for roughly 98% of depositors, those with savings less than USD 500,000. However, ongoing financial losses have reduced the immediate depositor payout, likely falling below USD 100,000 with each unresolved day of the banking crisis.

Commercial bank liabilities to depositors are estimated at around USD 93 billion, with liquid assets and required reserve deposits at BDL in the range of USD 13 billion, resulting in a financial gap of USD 80 billion. A comprehensive audit is crucial to resolving any ambiguity. Last month, a group of eleven banks filed a memorandum tying up litigation to the Ministry of Finance, requesting the settlement of USD 16.53 billion in loans to the public sector and USD 51.30 billion representing losses on BDL’s balance sheet as of December 31, 2020.

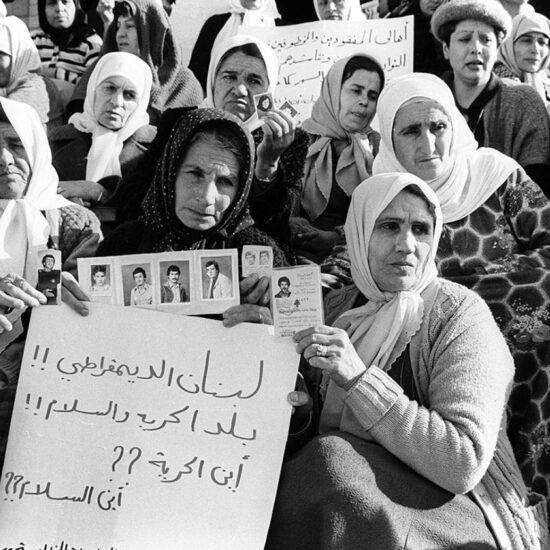

A core commonality between restructuring versions is that the lion’s share of bank losses continues to be borne by depositors. After four years of crisis, the boards of directors and shareholders of these zombie banks remain unaccountable for the failure of their financial institutions and their role in the country’s economic crisis.

The significance of the law is questioned today as 70% of core capital has eroded, according to the latest figures from Banque du Liban. Bank shareholders, mainly “PEP” (politically exposed persons) and leaders of different pressure groups, must acknowledge the primary responsibility of commercial banks to pay back their liabilities to depositors, regardless of the vast losses incurred during the crisis. There is a significant overlap between the country’s political class and those with financial interests in the banking sector, with a quarter of all board members of Lebanon’s biggest banks meeting the internationally recognized definition of a politically exposed person.

What Do the Reform Laws Say?

The latest version of the banking sector reform bill, introduced on Nov. 10, was crafted by Banque du Liban (BDL) and the Banking Control Commission of Lebanon (CCB). It features 48 articles outlining the restructuring or potential liquidation processes for Lebanese banks, with the final 10 articles dedicated to exceptional measures to ensure banking security.

The current law project under scrutiny, proposed by the government, observes the absence of any comprehensive financial audit or inventory of the assets and liabilities of commercial banks to determine what can be restructured. According to the proposed draft, each bank is supposed to appoint, with the approval of the Banking Supervision Committee, an auditor to examine the assets and liabilities of the bank. Based on this audit, for each bank individually, it is possible to distinguish between those suitable for restructuring (or remediation) and those requiring liquidation.

A second version of the law presented by the Banking Control Commission follows a standard process for reforming and liquidating banks. It sets to establish a higher banking commission that would decide which banks “need to be reformed” and which banks “need to be liquidated” after an objective appraisal is applied to each bank. This is done by finding the net value of assets for each bank and then considering action that would restore it to balance. In the process, losses would be absorbed along a “standard ordering,” starting with shareholders’ equity, then bonds, and then deposits, excluding those of the social pension fund, foreign embassies, and regional and international organizations. Additionally, banks considered viable for reforms will be subject to measures including bail-in, recapitalization from new investors, sale of some assets and liabilities to other financial institutions, and mergers.

70% of Core Capital Eroded: The Current Financial Landscape

In any case, according to aggregated financial figures until late in the third quarter of this year, the book value of core capital (banks owners’ stocks) had declined to around USD 4.7 billion from USD 15.9 billion in late October 2019. In other words, bank core capitals have lost 70% of their book value until this moment, representing the rights of the bank owners within their banks.

It’s worth noting that a significant portion of these capitals is fundamentally assessed in US dollars, especially concerning cash injections made by shareholders into their banks in the years preceding the crisis, which shields this portion of the capitals from the repercussions of exchange rate fluctuations.

In any case, it is expected that during the upcoming period, bank capitals will witness further contraction, with the adjustment of the official exchange rate used to evaluate budgets from 15,000 Lebanese pounds per dollar to a rate that is realistic and aligned with the parallel market rate, as planned by the Central Bank of Lebanon. However, estimating the extent of this contraction might be challenging today due to the presence of capitals assessed in hard currency.

In summary, it might be apparent that the struggle among banks for their capitals, within the context of the debate over the restructuring law, is not directly linked to the actual value of these capitals, which have essentially lost most of their value. It’s expected that they will lose more value after adjusting the exchange rate used in budget preparations and considering the losses resulting from the banks’ employment with the central bank. The struggle for these capitals, or what little value remains of them, is a battle to retain control over the banks. Erasing these capitals entirely and calling for recapitalization from new shareholders would practically mean changing the controlling entity of each bank. For this reason, banks fight to retain what remains of their capitals, even if it means maintaining the current status of struggling banks unable to provide the most basic expected services.

Maan Barazy is an economist and founder and president of the National Council of Entrepreneurship and Innovation. He tweets @maanbarazy.

The views in this story reflect those of the author alone and do not necessarily reflect the beliefs of NOW.