“When the coffers are empty and there is a need for more money there is printing of money, which devalues the currency. When you have financial problems, polarity will increase, and so does populism of the left and populism of the right. This can produce a period of disorder and can eventually lead to civil war.” Ray Dalio

Once dubbed the Switzerland of the Middle East for its robust banking system, Lebanon’s fiscal disrepute has shocked global banking regulators. Since the start of the uprisings in October 2019, 59 cash-strapped banks have shut their doors on depositors for the first time in Lebanon’s history, just ahead of a government default on its national debt.

An alternative cash-based system emerged – one with ties directly to the ruling party, the Free Patriotic Movement (FPM), and Hezbollah. It is controlled by those who are at present the ruling majority, and are appointed to find a solution through an agreement with the International Monetary Fund (IMF) for the 70 billion USD loss of depositors’ money.

For the last twenty years, the United States has failed to curb Hezbollah’s meddling in the banking system. Three banks were shut down in Lebanon when discovered by the US treasury to have had ties to Hezbollah and its Syrian allies, and engaged in money laundering activities.

Bank Al Madina, Lebanese Canadian Bank, and Jammal Trust Bank are three examples of how Hezbollah has tried over many years to infiltrate the Lebanese banking system. All three banks were shut down by Banque du Liban, the central bank of Lebanon, following orders from the US treasury. But, surprisingly, with all the surveillance the US treasury had placed on Lebanese banks over the years to clean up their act, Hezbollah and their allies have since managed to outmaneuver and outsmart the US treasury and its sanctions and seize total control over the entire monetary system in Lebanon. Welcome to the newly emerged “cash-based” economy, where Qard El Hassan is the only financial institution still standing.

What you have in Lebanon right now is a cash remittance system where all cash flowing into the country is controlled by a few groups and individuals taking large commissions – and those same people are charged with reforming the banking system.

So, what incentive does the current profiteering government have to reform the system? How can a sanctioned political party/militia and the sanctioned leader of another ruling party be incentivized to reform the system if it takes profit out of their own pockets?

According to the World Bank, remittances to Lebanon in 2019 stood at 7.41 billion USD, in 2020, 6.63 billion USD USD, making up 25.6 percent of the GDP. In 2021, it was 6.6 billion USD.

Based on the World Bank’s projections, Lebanon would be the 30th largest recipient of remittances in the world, and the 16th largest among developing economies in 2021. Lebanon would receive more remittances than Ghana ($4.5bn), Kenya ($3.7bn) and Haiti ($3.1bn), and less remittances than El Salvador ($7.3bn), Honduras ($7bn), and Sri Lanka ($6.7bn) among developing economies.

Lebanon ranked first in the MENA region and second globally (behind Tonga “43.9 percent”) in terms of remittance contribution to GDP, which stood at 34.8 percent in 2021, followed by the West Bank & Gaza (16.7 percent of GDP).

So how are Lebanese immigrants sending money to loved ones in Lebanon?

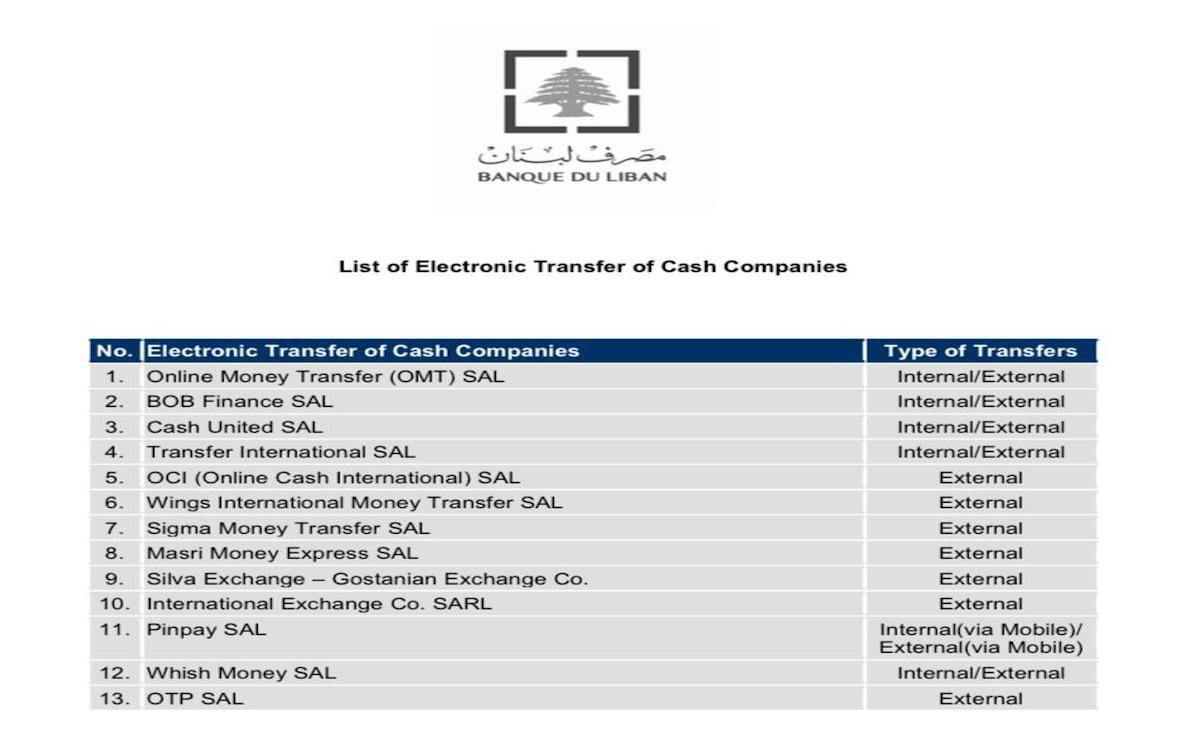

According to Banque du Liban (BDL), there are 13 companies that can receive and wire remittances in Lebanon right now. To be able to operate such a company you would need a license from the Central Bank. Of those thirteen companies, five can transfer money in and out. These are indicated in the graph.

If those five companies are handling the cash economy, how much is the banking sector handling in fresh cash now?

According to a prominent banker, about 1.3 billion “fresh” USD sits in bank accounts in cash, and its turnover is rather high.

The rest of the cash economy is handled mainly by the five companies that can transfer money in and out of the country.

In terms of market share, Western Union, through its two agents in Lebanon OMT and BOB Finance, seems to be leading the cash received and cash sent flow. OMT holds the largest market share, followed by BOB finance.

These two companies seem to have replaced the banking system of an unbanked country, and hold the cash monetary system with their market share. In September 2022, OMT announced its sponsorship of the Beirut Marathon, an event that since its foundation has traditionally been sponsored by the banks.

A closer look at OMT reveals its shareholders as Amal Abou Zeid, with his two sons represented on the board, Toufic Mouawad, and Imad Machnouk, who is married to Joya Mouawad, the daughter of Toufic Mouawad, and brother of the former Minister of Interior, Nouhad Machnouk.

OMT claims that it has 1,200 locations across the country, where it can receive and wire money from. If you look closely at the map presented by the company on its web page, the majority of those branches happen to be in Baabda and the southern districts of Lebanon, and Beirut’s southern districts – areas run by the ruling parties.

One could argue that most “unbanked” people reside in such populated areas, but one can also argue that the majority of cash circulating outside the banking system is taking place in those areas. Most of the foreign exchange shops as well, which are dominated by Hezbollah’s men, tend to be prominent in the southern district of Beirut. Of 1200 OMT locations, over 600 are found in Shia-dominated areas.

In comparison, its second largest competitor, BOB Finance, operates 700 Western Union points of location, dominant mainly in Mount Lebanon, as opposed to the South. It is not surprising that BOB Finance gears more towards Mount Lebanon, as it operates as part of Bank of Beirut, whose chairman, Salim Sfeir, currently holds the role of the president of the Association of Banks in Lebanon (ABL), which represents all banks.

OMT cites on its website that in 2019 it transacted 120 million USD a month. That accrues to 1.44 billion in a year. In 2019, remittances to Lebanon were 7.41 billion USD. That makes OMT the handler of cash of 20 percent of the total remittances. Second in place is BOB Finance.

The amount of remittances handled by OMT rose sharply in 2021. While the company hasn’t cited the new number on its website, it is calculated by people in the know to be close to 2.8 billion USD. 2.8 billion USD of the remittances for 2021 (6.63 billion USD) calculates to about 42 percent. We can safely say that the company dominates the cash economy in the absence of a once-prominent banking sector.

So, how do OMT and Bank of Beirut (BoB) Finance make money?

Officially, there are two ways that these institutions make their money. One being the set fee of the amount wired, and the other being the difference in the exchange rate between the currency wired and currency received.

According to the World Bank data registry, if you lived in France and wired money to Beirut in Q1 of 2020, you would have paid an average of 9.7 percent in fees from the aggregate number of institutions that can wire money to Lebanon.

If you wired that 200 USD via Western Union from France to Western Union’s Beirut agent, OMT, in Q1 2020, you would have been charged 12.12 percent in fees, or 24.24 USD. That is made up of a set fee of 7 USD, and an exchange rate margin spread of 8.62 percent.

For the same period, if you wired 500 USD via OMT from France to Beirut, the cost would have been 16.74 percent. Of that, 36.23 USD would be your fee, and 9.49 percent would be your foreign exchange margin cost, together, it comes to a total fee of 83.70 USD. (data taken from the World Bank Data Room on Remittances)

So, to be on the conservative side, adding it all up and depending on where you are wiring from and how much you are wiring, the average cost of wiring money via Western Union to Lebanon becomes between 12 percent and 16 percent. The World Bank states that the global average cost of a remittance remains a “painfully high” 6.5 percent. Lebanon is currently at double that amount. The United Nations is aiming at a 3 percent target, identified as a Sustainable Development Goal.

If we take the lower end of the fees, 12 percent, the Lebanese citizen – “the receiver” – is paying an additional 2 percent fee on collection at OMT. So, we are now at 14 percent in total fees.

When you enquire about the 2 percent, OMT tells you it is for cash handling of USD and the cost of cash-carrying, which is a costly exercise worldwide. At initial contact I was told it was imposed by the central bank, but after much work and questioning, I was able to debunk this and conclude that it is, in fact, imposed by OMT.

An additional way that OMT makes money is by collecting dollars from the market and handing it to the central bank. The BDL’s Circular 614, issued in 2021, authorized money transfer companies operating in Lebanon’s ability to apply for a forex operating license in order to carry out exchange operations with funds received from abroad at the request of their customers.

So, let us assume that of the 120 million USD OMT says it handled “per month” in 2019, half is exchanged on the spot for Lebanese Lira and half is handed to the central bank, which in turn remunerates OMT by an amount between two or three percent of the total amount delivered. The figure I was told varies between two or three percent, no higher and no less. It is BDL’s decision to say who gets two percent and who gets three percent. Naturally, you would expect that the one that collects the most dollars gets the higher cut of fees.

If you are handling 2.8 billion USD’s worth of in cash transactions per year at a running cut of 14 percent (12+2), that would make your total revenue 392 million USD for that year. Add on top of that, half of the 2.8 billion USD (1.4 billion) is collected and handed to the central bank at a fee of 3 percent, that’s 42 million USD a year in addition. Your total revenue for the year becomes a whopping 434 million USD!

No business runs without expenses. So, let us suppose that the running cost is half of that amount, you could be running at 217 million USD in profit a year. By way of comparison, 11 billion was distributed in dividends in the banking sector (59 banks) between 2011-2018. That is 1.57 billion USD a year for 59 banks. OMT has become the size of an Alpha bank.

BoB Finance’s revenue is lower than the dominant OMT, but the company still manages to take the second spot in handling the cash economy.

It is no secret where Amal Abou Zeid’s political alliance lies. He was on the elections list with the FPM movement twice, and lost twice in the last two parliamentary elections – once to MP Ziad Assouad of Jezzine. It is also no secret that Selim Sfeir’s political alliance lies with the FPM.

At no time in history did Lebanon’s banking sector represent one political color. The banking sector had multiple allegiances and represented all political parties throughout history. It is no coincidence that two of the largest monetary handlers in the country at the moment have ties to the FPM, the party belonging to the current Lebanese president, whose son-in-law is sanctioned by the US government. This is the same party that rules by majority with its Hezbollah and Amal allies, and is entrusted to find a solution with the IMF to the country’s economic crisis.

It is also no coincidence that no solution to the banking sector’s quagmire has been offered?

Through their policies and regional politics, the president and his allies have managed to destroy the sector and create an alternative cash economy that benefits themselves and specifically the sanctioned individuals.

Amal Abou Zeid’s relationship to the President and his son-in-law is well known. Amal Abou Zeid also happens to be a shareholder of Astro Bank, along with Jamil El Sayyed, Vladimir Sautov, and Nacim Ould Kaddour.

Vladimir Sautov was a corporate director of Irkut Corp an arms manufacturer in Russia.

Nacim Ould Kaddour is the eldest son of former CEO of Sonatrach, Abdelmoumen Ould Kaddour, who was arrested by Interpol in October 2021 and extradited back to Algeria, where he is serving a jail sentence. Under the tenure of Abdelmoumem Kaddoour, Lebanon renewed the infamous fuel import contract, purporting it was done “government to government” while it was a source of corruption in the Lebanese economy. His son Nacim is entangled in corruption cases in Algeria, and is linked to suspicious activities in credit Suisse Bank. It is unclear if he still holds his shares in the bank.

Aristide Vourakis, the current CEO of Astro Bank, is the former Deputy CEO of Bank Audi. He resigned during the uprisings in 2019. So, how did the former Deputy CEO of Bank Audi make a jump to a bank whose majority shareholders come from the March 8th movement.

In 2008, Aristide Vourakis was assigned as part of a team of international banks to advise on strategic options for Bank Audi, including a multi-billion USD merger with a MENA institution to create a mega bank in the MENA region. Working along Vourakis was FPM’s economic advisor and a close friend of Gebran Bassil, Karim Noujeim. Two years into the job at Audi Bank, Vourakis quit, and later joined Astro Bank as its CEO.

One could argue that this “cash remittances” money is the lifeline that is keeping Lebanon alive at the moment in the absence of the collapsing salaries of many employees. But, it is also the drug that is suppressing any uprisings in the street that might pressure the government into finding a solution.

And where is Lebanon today regarding the Anti-Money Laundering rules and the Counter-Terror Financing (CTF) Act in the abundance of cash transactions taking place today, and the cash economy that has been bred? The banking sector had complied with these rules. In fact, pre-crisis Lebanon had five corresponding banks in the US to deal with, compared with Mexico which had only two. Today the banks have five but they operate solely on a cash basis.

Lebanon is three years into the crisis and the Lebanese government is yet to reach a bailout plan with the IMF. In April 2022, a staff-level agreement was reached which Lebanon has not delivered on. The IMF has demanded reforms from the Lebanese government that it has not fulfilled.

Those profiting from the current cash economy have a win-win situation brewing. The longer Lebanon goes without an IMF plan, the more cash they make. And when, or if, an IMF plan should play out, and the banking sector gets restructured, they will be the first to show up with the cash at hand to buy out the weakest banks. Who, then, is responsible for the misery inflicted on the average Lebanese citizen? Is it still the bankers?

Samara Azzi is a Lebanese investment banker based in Geneva. She can be reached on Twitter.

The opinions expressed are those of the author only and do not necessarily reflect the

views of NOW.