On Tuesday morning, Lebanon’s national currency, the lira, sunk to a new all-time low of 100,000 to $1, a symbolic milestone of how desperate the situation has become in the country.

As the lira reached the record low, the economic situation shows no signs of improving, with Lebanon’s politicians continuing to fail at doing the bare minimum to stem the country’s collapse.

What led to the collapse: The economic crisis, dubbed one of the worse that the world has seen in 150 years by the World Bank, began in October 2019 as the country’s economic and financial institutions started to unravel.

For decades, Lebanon was borrowing money in order to fund government deficits, with the country’s elite using the money to enrich themselves and their friends.

This came to a head in 2019 when dollars started to dry up, leading to a rise in the exchange rate and hyperinflation.

In response, a parallel market emerged where exchange houses and, in the initial months of the crisis, some businesses would buy and sell dollars at the market rate.

Refusal to change: In most countries facing a similar situation, the government would implement reforms in an effort to limit inflation and the devaluation of the currency.

However, in Lebanon, the politicians have continued to do nothing, failing even to pass a capital control law and instead allowing banks to impose their own, and possibly illegal, capital controls that have frozen depositors out of their savings.

This led to over a dozen depositors holding up banks nationwide to demand access to their trapped money, including through lawsuits, with one Lebanese court ruling that the bank had to pay the depositor their entire savings.

In response, the banks have gone on an indefinite strike, making it harder for Lebanon’s population to access their money and survive amid the worsening crisis.

Lebanon has also had several helping hands extended to it by the French and the International Monetary Fund, which would have helped to begin the process of rebuilding the country.

Following the August 4 Beirut Port explosion, French President Emmanuel Macron offered to hold a conference to raise potentially billions of dollars in aid for Lebanon on the condition that a government is formed and reforms passed by a specific deadline. None of this would come to fruition.

The Lebanese government has also reached a staff-level agreement with the IMF in April 2022 that would see the international body handing Lebanon billions of dollars in loans as long as reforms were passed and implemented, something that has yet to occur almost a year later.

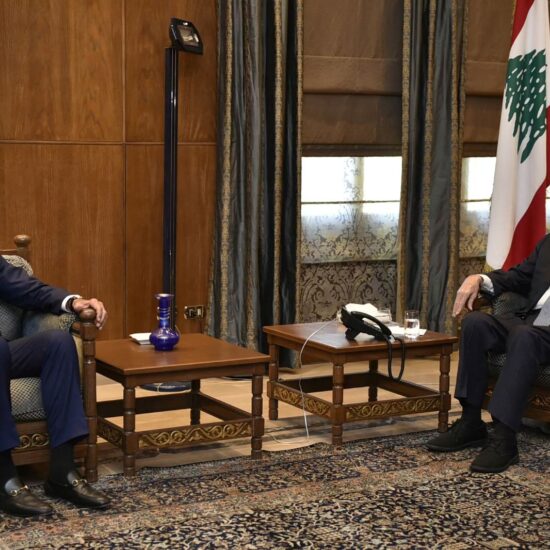

Parliament cannot currently pass any legislation as it is in a special electoral session with MPs trying and failing to elect a new president; a process that has left the country without a president for 134 days.

The government is also only acting in a caretaker capacity as Prime Minister Najib Mikati failed to form a government following the May 15 elections before then-President Michel Aoun left office on October 31, drastically limiting the powers awarded to the government when there is a vacancy in Baabda.

Making things worse: Lebanon’s Central Bank (BDL) also instituted its own exchange rate, Sayrafa, in an attempt to bring down the value of the lira and eventually unify the exchange rates.

Instead, Sayrafa has become more of a tool by BDL to temporarily bring down the rate, only for it to go back up after a couple of weeks.

The same occurred when BDL would flood the market with dollars in its reserves. While the rate would temporarily decrease, it would quickly rise up again and the country’s reserves would be further depleted.

The raising of the official exchange rate also helped to contribute to the worsening crisis as BDL raised the value of the lira, officially pegged at 1,507 to $1, to 15,000. This flooded the market with more lira and only saw the rate and inflation further skyrocket as this was done without any concurrent reforms put in place.

Further collapse: The government currently has no plan on how to pull the country out of the economic crisis and is, instead, relying on band-aid measures from BDL to provide momentary relief.

Parliament is still no closer to electing a president than it was when it started holding electoral sessions on September 29, but even when a president is finally elected, it is not clear when Lebanon’s politicians will finally start to work at pulling the country out of the crisis.

Until that happens, there is little hope that the situation in the country will start to improve.

Nicholas Frakes is a senior reporter with @NOW_leb. He tweets @nicfrakesjourno.